Market Rocks Review – A Scam Broker in Disguise?

When choosing a forex broker, the first thing any trader should ask is: Can I trust them with my money? Because in the world of online trading, appearances can be deceiving. Some brokers pretend to be legitimate, showing off professional-looking websites, fake licenses, and glowing reviews. But when it comes time to withdraw funds, the truth comes out.

One such broker raising red flags is Market Rocks. At first glance, they claim to be an established forex platform, offering multiple account types, trading tools, and attractive conditions. But after investigating deeper, things don’t add up—their regulation is fake, their website was registered only recently, and their reviews tell a different story.

So, is Market Rocks a trustworthy broker or just another offshore scam? Let’s break down the facts and uncover the truth behind this suspicious company.

Market Rocks – General Information

Before investing with any broker, it’s crucial to check their basic details. A legit company should provide transparent information about its platform, accounts, leverage, and contact details. Let’s break down what we found about Market Rocks.

Basic Details

| Category | Details |

| Website | marketrocks.com |

| Established | 🚩 Claims 2010, but domain bought in 2023 |

| Regulation | 🚩 M.I.S.A. (Fake, offshore) |

| Leverage | 1:200 |

| Platforms | WebTrader, Tablet & Mobile Trader |

| Restricted Countries | Mwali |

💰 Account Types & Deposits

Market Rocks offers different types of accounts, but the required deposit amounts raise serious concerns. Here’s what they claim to provide:

- Beginner Account – $10,000 deposit

- Advanced Account – $50,000 deposit

- VIP Account – $100,000 deposit

🚩 Red Flag: Legitimate brokers allow traders to start with as little as $50–$250. A $10,000 minimum screams high-risk fraud, as scammers often push big deposits to trap victims.

📞 Contact Information

- Email: [email protected]

- Phone: +44 800 048 8474

🚩 Red Flag: The only contact options are email and a UK phone number. But no real company details, physical office, or corporate registration info are listed. A trustworthy broker provides full transparency about their location and legal status.

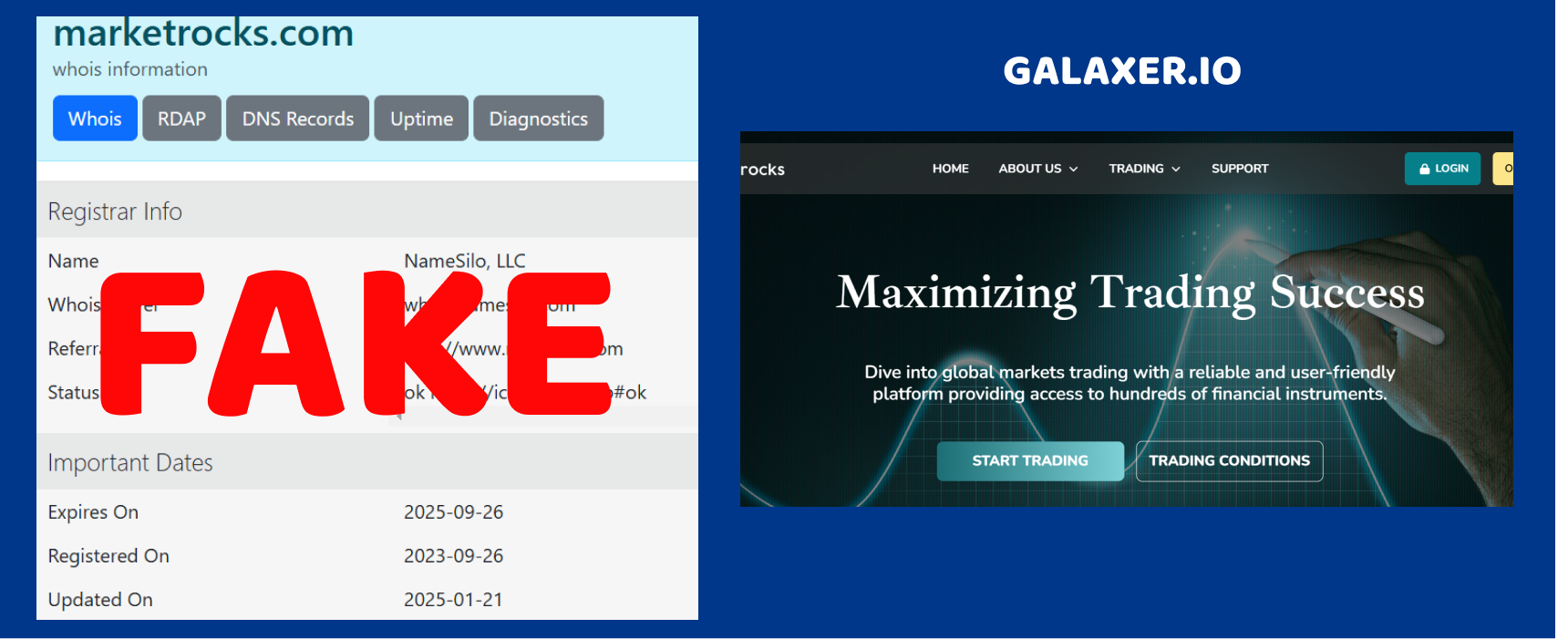

Market Rocks – Suspicious Domain Registration Date

One of the first red flags when investigating a broker is checking how long their website has been around. If a company claims to have years of experience, yet their domain was only registered recently, it’s a clear sign something isn’t adding up.

For Market Rocks, the discrepancy is glaring. According to their claims, they were established in 2010, which should mean they’ve been in the industry for over a decade. However, when we checked the domain registration date, we found that it was purchased on September 26, 2023.

Think about it—why would a company that has supposedly been around since 2010 only buy their domain in late 2023? It doesn’t make sense. If they were a legitimate broker operating for years, their website should have been active for much longer. This kind of inconsistency is a classic scam tactic. Fraudulent brokers often fabricate a long history to appear credible, but the domain registration date exposes the truth.

This raises another question: where was Market Rocks operating before they bought this domain? Were they even a real company? Or did they simply create a fake backstory to trick unsuspecting traders?

A serious brokerage firm builds trust over time, and its online presence should reflect that. A newly registered domain combined with a claim of “more than 10 years in the industry” is a strong indication of deception. And when a company starts off with lies, can you really trust them with your money?

Market Rocks – Fake Regulation, No Real Protection

When it comes to forex brokers, regulation is everything. A broker without a legitimate financial license is nothing more than a glorified gambling website—except the house always wins, and you have no way to get your money back.

So, we checked what kind of license Market Rocks holds. The result? They claim to be regulated by M.I.S.A. (Mwali International Services Authority). Sounds official, right? Not really.

Why is M.I.S.A. a Fake Regulator?

M.I.S.A. is one of those so-called “offshore regulators” that brokers use to create an illusion of legitimacy. In reality, it offers zero oversight and doesn’t protect traders in any meaningful way. Any company can get this license by simply paying a fee—no strict financial checks, no transparency requirements, and no consumer protection.

This is a common trick among scam brokers. They pick jurisdictions like Mwali (Comoros), St. Vincent and the Grenadines, or the Marshall Islands because these places don’t regulate forex trading at all. That means Market Rocks can:

- Manipulate trades to make clients lose money

- Refuse withdrawals whenever they want

- Disappear overnight with investors’ funds

And guess what? There’s no legal way for victims to recover their money.

Real Regulation vs. Fake Regulation

Compare this to a properly regulated broker under authorities like:

- FCA (UK)

- ASIC (Australia)

- CySEC (Europe)

These regulators strictly monitor brokers, require them to segregate client funds, and offer compensation schemes in case something goes wrong. A real broker with a real license wouldn’t be hiding behind an offshore registration.

So why would Market Rocks choose M.I.S.A. instead of a serious regulator? The answer is simple: they don’t want oversight. They want complete control over your money with no risk of being held accountable.

At this point, the picture is clear—Market Rocks is just another offshore scam disguised as a forex broker. If they’re lying about their regulation, what else are they lying about?

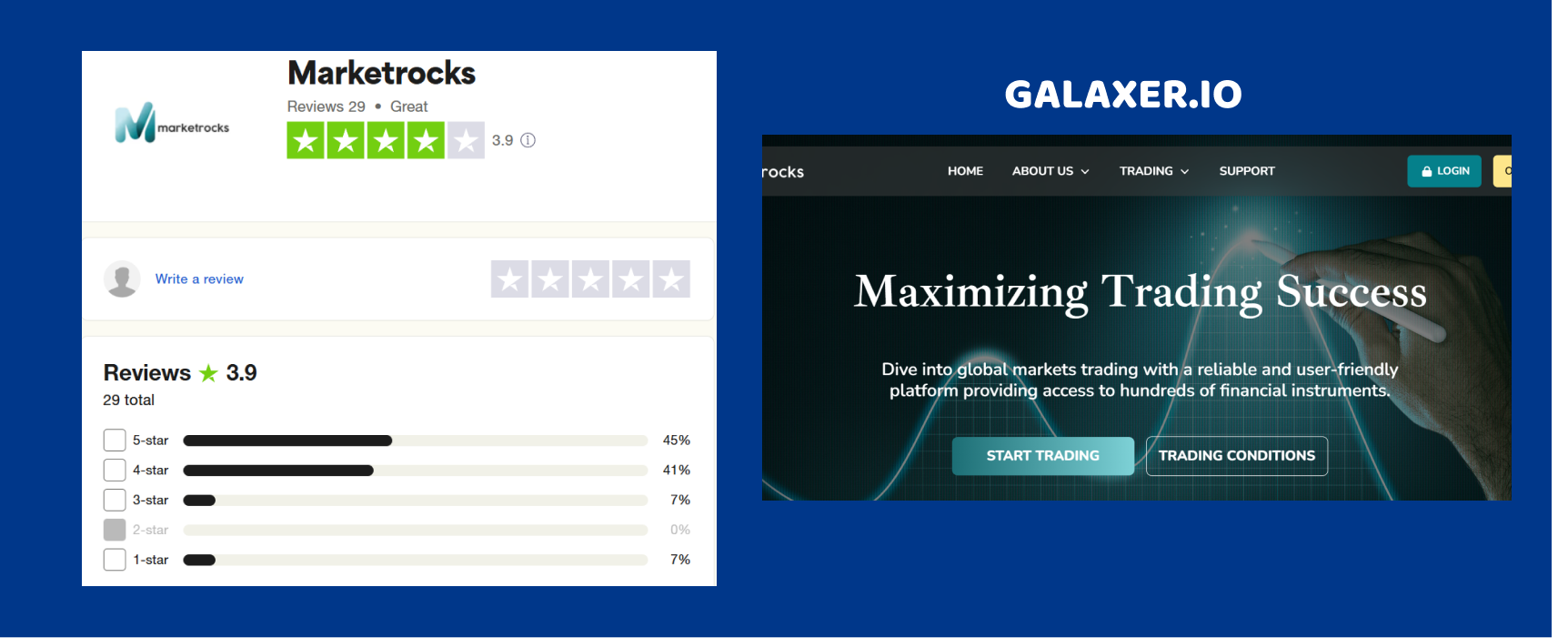

Market Rocks – Suspicious Reviews on Trustpilot

One of the easiest ways to spot a scam broker is by analyzing its reviews. A real company will have a mix of positive and negative feedback, while scam brokers either have suspiciously high ratings with fake reviews or a flood of complaints from scammed traders.

Trustpilot Score: 3.9 – Something Feels Off

At first glance, a 3.9 rating might seem decent. But let’s look deeper. Market Rocks has only 29 reviews, which is a very small number for a broker that claims to have been in business since 2010. If they were truly a well-established company, wouldn’t there be hundreds or even thousands of reviews from real traders?

And here’s where it gets interesting—despite the “average” rating, 4 of these reviews are marked as bad. That means around 14% of users have already raised red flags about their experience.

Fake Positive Reviews?

Another classic scam tactic is review manipulation. A quick scan of the positive reviews often reveals key patterns:

- Similar writing styles – Many five-star reviews sound like they were written by the same person or a copy-paste template.

- Lack of details – Fake reviews are usually vague, saying things like “Great broker! Fast withdrawals!” without giving any real insight into the platform’s performance.

- Over-the-top praise – Real traders might say a broker is “good,” but they won’t write exaggerated claims like “Best broker ever, 100% reliable, no issues at all!”

When a broker has a low number of reviews but still manages to have glowing five-star ratings, it’s usually because they’ve paid for fake testimonials to cover up complaints.

Real Trader Complaints

Now, let’s talk about the 1-star reviews—the ones that actually matter.

Negative feedback on scam brokers often follows a pattern, and Market Rocks is no different. Common complaints include:

- Withdrawal issues – Users report that they can’t get their money out after making deposits.

- Fake bonuses and hidden fees – Many scam brokers lure traders with “bonus money,” then lock their funds behind impossible withdrawal conditions.

- Aggressive account managers – Victims mention pushy sales tactics, constant phone calls, and pressure to deposit more money.

If a broker is legit, it shouldn’t have so many unresolved issues. And yet, Market Rocks seems to have a growing number of frustrated traders.

The Bottom Line? Untrustworthy.

A real broker doesn’t need to buy fake reviews to maintain its reputation. If Market Rocks is already manipulating its online image, what are they trying to hide? The answer is clear: a history of scamming traders. And once they take your money, those “positive reviews” won’t help you get it back.

Market Rocks – A Classic Offshore Scam

After thoroughly investigating Market Rocks, the verdict is clear—this broker is nothing more than an offshore scam operation designed to steal money from unsuspecting traders. Let’s sum up the key reasons why Market Rocks cannot be trusted:

❌ Fake Regulation – The broker is “licensed” by M.I.S.A., an offshore entity that offers no real oversight or trader protection. This means Market Rocks can manipulate trades, block withdrawals, and vanish overnight—without any consequences.

❌ Suspicious Website & Fake History – They claim to have been established in 2010, but their domain was only registered in September 2023. A real broker with 10+ years of experience wouldn’t have a brand-new website.

❌ Unrealistic Deposit Requirements – Requiring a $10,000 minimum deposit for a “Beginner Account” is absurd. Legitimate brokers offer entry-level accounts starting at $50–$250. This is a clear attempt to drain victims of large amounts of money upfront.

❌ Manipulated Reviews – While they have a 3.9 rating on Trustpilot, many of the reviews appear fake or generic, while real traders complain about withdrawal issues and aggressive sales tactics.

❌ No Transparency – There is no verifiable company information, no real address, and no way to track who is behind this broker. A legitimate forex broker provides full transparency, while scams operate in the shadows.

Final Warning: Do Not Invest with Market Rocks

Everything about this broker screams fraud. From fake credentials to manipulated reviews and high-pressure deposit tactics, Market Rocks follows the exact same blueprint as countless other forex scams. If you deposit money here, expect delayed withdrawals, hidden fees, and endless excuses until your funds disappear completely.

🚨 If you’re looking for a safe trading platform, avoid Market Rocks at all costs. Instead, stick to brokers regulated by trusted authorities like the FCA, ASIC, or CySEC—they offer real protection, not just an offshore illusion.