Bux Berg Review – Another Shady Broker to Watch Out For?

If you’ve come across Bux Berg, you might be wondering—is this broker legit or just another scam? Their website looks professional, their promises sound convincing, and they claim to offer top-tier trading conditions. But here’s the thing: scam brokers know exactly how to appear trustworthy—until you try to withdraw your money.

Our investigation into Bux Berg uncovered serious red flags:

- They operate without a license (meaning no financial protection for traders).

- Their reviews are suspiciously manipulated, with a flood of fake positive feedback drowning out real complaints.

- Their domain registration and company founding dates don’t match, raising questions about their actual history.

- And their account conditions make little sense, with sky-high minimum deposits and missing leverage details.

So, is Bux Berg a legitimate broker, or just another high-risk operation designed to take your money? Let’s break it down and expose the truth.

Bux Berg – General Information

Before trusting any broker, it’s crucial to check their basic details. In the case of Bux Berg, things don’t look promising. Below is a breakdown of key information:

| Category | Details |

| Website Domain | buxberg.com |

| Trading Platforms | WebTrader, Mobile Trader, Tablet Trader |

| Restricted Countries | Hong Kong, North Korea, Iraq, United States |

| Regulation Status | ❌ Unlicensed (No regulation) |

| Trustpilot Score | ⭐ 3.2/5 (Suspicious reviews) |

| Total Reviews | 41 reviews (12 negative) |

| Year Established | 2021 (but domain registered in 2020 🤔) |

| Leverage | ❌ No information provided |

| Account Types | Beginner Account – $2,500

Standard Account – $5,000 Advanced Account – $25,000 |

| Contact Info | 📧 Mail: [email protected]

📞 Tel: +1 800 787 5082 |

Red Flags from This Information

- No Regulation: Bux Berg operates without any financial oversight, meaning your money is completely unprotected.

- High Minimum Deposits: A $2,500 beginner account? That’s absurd. Legitimate brokers offer much lower entry points.

- No Leverage Info: Every serious broker clearly states leverage details—Bux Berg avoids this, likely to manipulate trading conditions.

- Fake or Manipulated Reviews: Trustpilot score is too low, with evidence of suspicious review patterns.

- Limited Contact Info: Only an email and one phone number—no real physical office or transparency.

All of this adds up to one conclusion: Bux Berg is a high-risk, unregulated broker that traders should avoid.

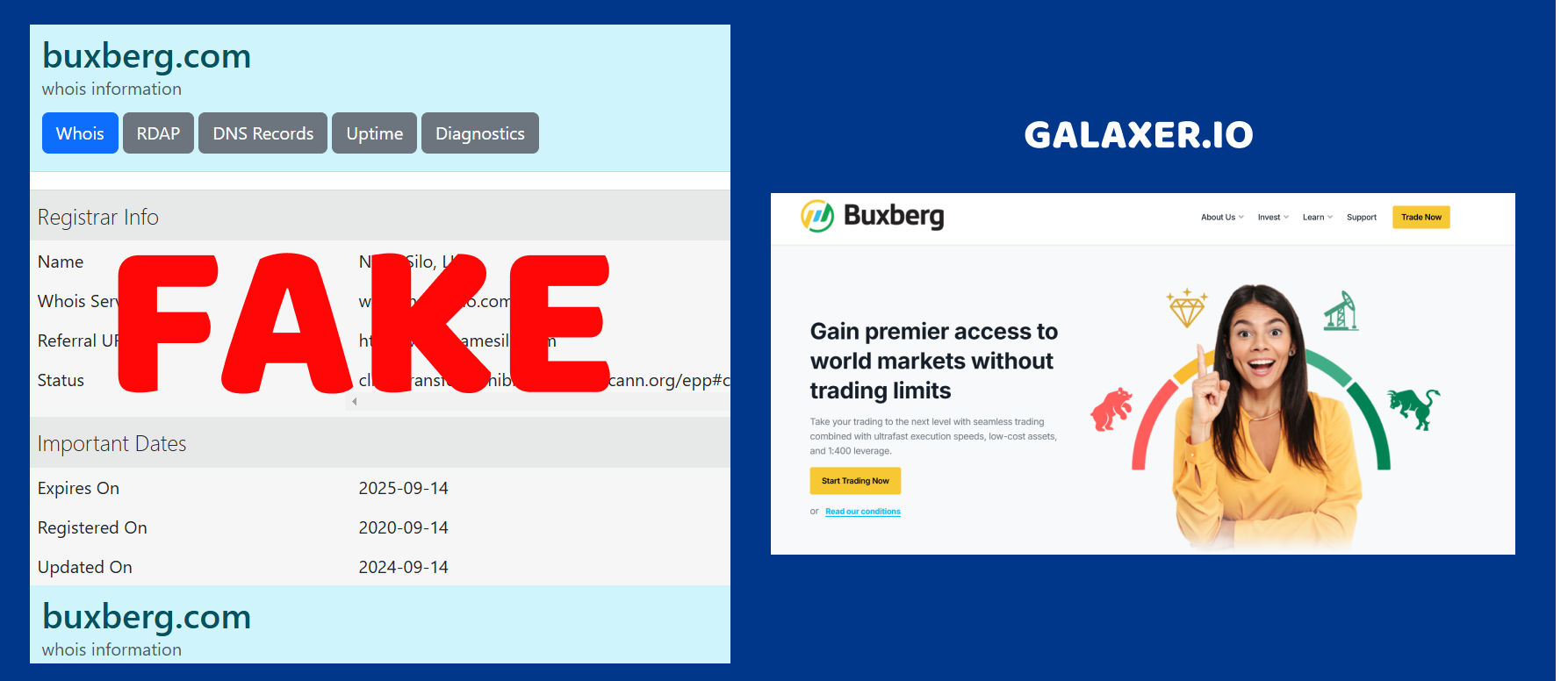

Bux Berg – Suspicious Domain Registration Timeline

One of the first things that raises a red flag about Bux Berg is the inconsistency between the company’s established date and the date of domain registration.

- Claimed establishment year: 2021

- Domain registration date: September 14, 2020

At first glance, this might seem normal—maybe they registered the domain before officially launching. But let’s think critically for a second.

If a brokerage was truly established in 2021, wouldn’t it make sense for them to have a domain registered around that time? Instead, their website existed before the company was supposedly founded. This mismatch suggests one of two things:

- They might be lying about their founding year. Many scam brokers inflate their experience to appear more trustworthy. After all, who would trust a broker that just popped up yesterday?

- They could have acquired an old, abandoned domain. This tactic is common among scammers who want to make their operation look more credible. By using a pre-existing domain, they can mislead potential investors into thinking they’ve been around longer than they actually have.

Now, ask yourself—why would a legitimate broker feel the need to manipulate these details? Real financial firms have no reason to play games with their founding dates. But scammers? That’s a different story.

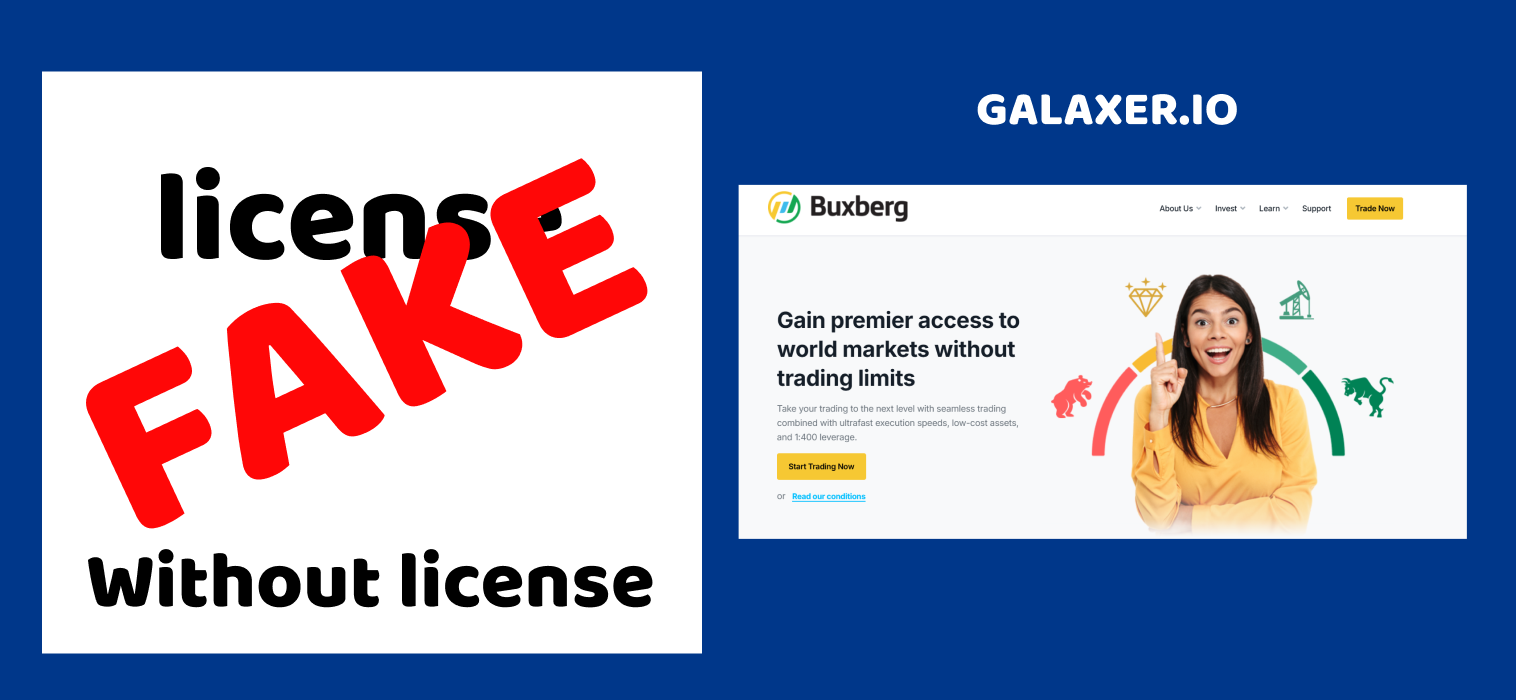

Bux Berg – Operating Without a License

Here’s where things go from bad to worse. Bux Berg operates without any financial regulation whatsoever.

- Regulation status: ❌ Without licence

- Type of license: ❌ None

Let’s break this down. A licensed broker must comply with strict financial rules, maintain transparency, and be accountable to a regulatory body. In contrast, an unlicensed broker operates in a grey zone—meaning they can disappear with your money, and there’s no authority to hold them accountable.

Now, let’s consider this: if Bux Berg were truly a trustworthy broker, why wouldn’t they get licensed? The answer is simple—because they don’t want to be monitored. Regulation means restrictions on how they handle client funds, strict auditing, and requirements for fair trading conditions. None of that benefits a scam operation.

Another alarming sign? They claim to restrict clients from Hong Kong, North Korea, Iraq, and the U.S. While that might sound like they’re following some legal guidelines, in reality, it’s a classic scam tactic. By adding these restrictions, they try to appear more “legitimate” while still targeting investors in other regions where they can operate freely without consequences.

The bottom line? No regulation = no protection. If you deposit money with Bux Berg and they decide to block your account or refuse withdrawals, you have zero legal recourse. And that’s exactly how scam brokers operate.

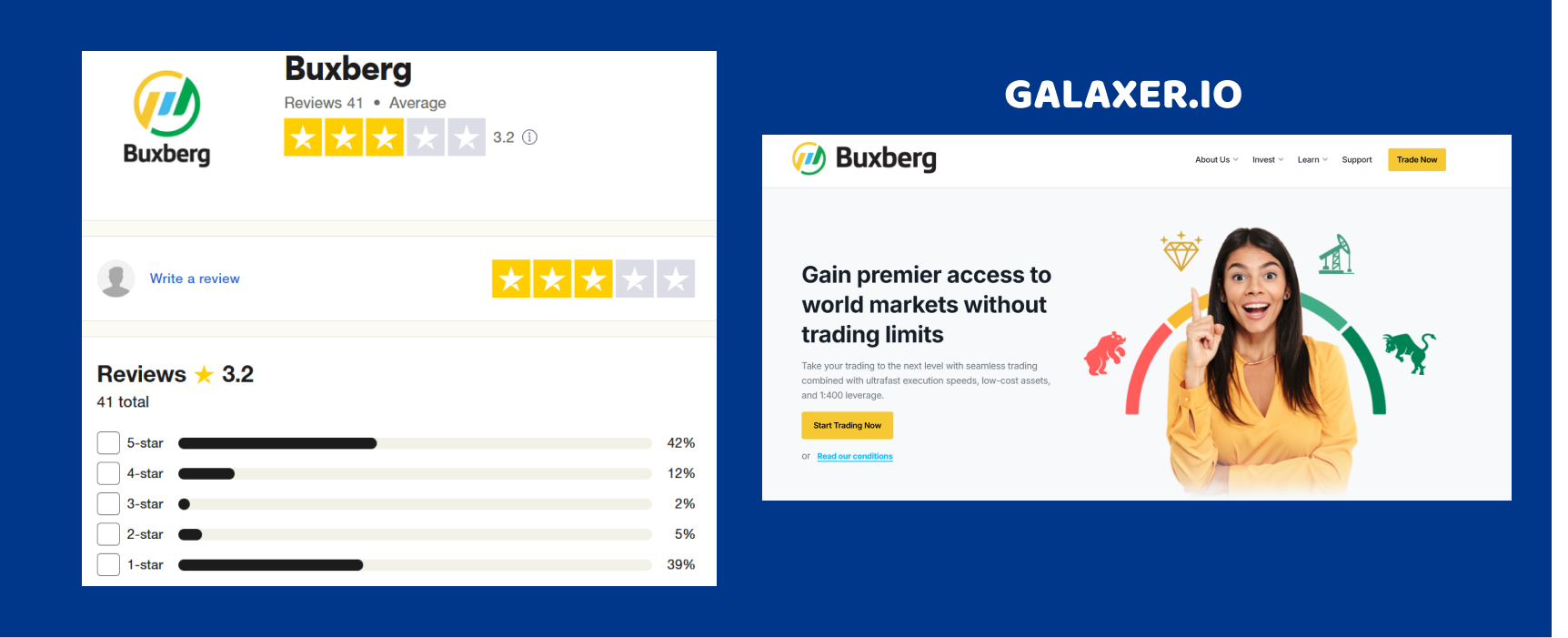

Bux Berg – Suspicious and Manipulated Reviews

When it comes to trust, reviews can be a goldmine of insights—if you know how to read between the lines. And in the case of Bux Berg, the red flags are everywhere.

- Trustpilot Score: ⭐ 3.2/5 (Below the safe threshold of 4.0)

- Total Reviews: 41

- Bad Reviews: 12 (nearly 30% of total reviews are negative)

At first glance, a 3.2 rating might seem “average,” but in the world of brokerage reviews, anything below 4.0 is a major warning sign—especially when combined with a pattern of negative feedback.

Signs of Fake Reviews

When analyzing the reviews on Bux Berg, one thing stands out: the positive reviews follow a suspicious pattern.

- Similar writing style – Many positive reviews use generic phrases like “great broker,” “smooth withdrawals,” and “excellent service” with little to no detail. Real traders usually mention specific experiences.

- Few details about trading – Legitimate traders often talk about spreads, platform reliability, or order execution. Here, the 5-star reviews are vague and overly enthusiastic.

- A sudden burst of good reviews – Scam brokers often flood platforms with fake positive feedback after receiving too many negative reviews.

Negative Reviews Tell a Different Story

Now, let’s look at the negative reviews—the ones that are harder to fake. What do they say?

- Withdrawal issues – Users report delays, excuses, or outright refusal to return funds.

- Aggressive account managers – Traders mention high-pressure tactics to deposit more money.

- Blocked accounts after profit – Some claim that once they made a profit, their accounts were mysteriously “suspended.”

The Verdict? The Reviews Are Likely Manipulated

The combination of a low rating, repetitive positive reviews, and alarming negative feedback paints a clear picture: Bux Berg is trying to bury real complaints under a pile of fake praise.

And let’s be honest—if a broker has to fake its reputation, what does that say about their actual service?

Final Verdict – Bux Berg is a Scam Broker

After thoroughly analyzing Bux Berg, the evidence is overwhelming—this broker is not to be trusted. Let’s recap the key red flags:

🚩 Unlicensed and Unregulated – Bux Berg operates without any legal oversight, meaning traders have zero protection if things go wrong. A legit broker would always have proper regulation.

🚩 Suspicious Founding Date – They claim to have been established in 2021, yet their domain was registered in 2020. This mismatch suggests they might be lying about their history or using an old domain to appear more credible.

🚩 Manipulated Reviews – Their Trustpilot score is only 3.2, and while there are positive reviews, they look artificial—generic wording, vague details, and a sudden influx of good ratings. Meanwhile, real users complain about blocked accounts, withdrawal issues, and aggressive tactics.

🚩 Unrealistic Trading Conditions – A $2,500 minimum deposit for a “Beginner” account? That’s absurd. Legitimate brokers offer much lower entry points. On top of that, they hide leverage details, which is a classic sign of unfair trading conditions.

🚩 Minimal Contact Information – Just an email and a phone number. No real address, no transparency—another strong indication that they don’t want to be found when things go south.

The Bottom Line

Bux Berg checks every box for a typical scam broker—no regulation, misleading history, fake reviews, shady trading conditions, and complaints from real traders. Depositing money here is a huge risk.

If you’re looking for a safe, reliable broker, Bux Berg is NOT the place to trade. Stay away and warn others before they fall into the same trap!