24 Yield Review – Scam or Legit Broker?

When it comes to online trading, trust is everything. The industry is flooded with brokers claiming to offer the best conditions, top-tier security, and profitable opportunities. But how many of them are actually legitimate? 24 Yield presents itself as a professional and well-established broker, but after our investigation, things started to look suspicious.

From inconsistent company history to questionable regulation and manipulated reviews, there are several red flags that traders need to be aware of. Is 24 Yield really a reliable broker, or is it just another cleverly disguised scam? Let’s break it down and see what’s really going on behind the scenes.

24 Yield: General Broker Information

Here’s a structured overview of 24 Yield based on our findings:

| Category | Details |

| Trading Platforms | TradingView |

| Restricted Countries | United States |

| Leverage | No information provided |

| Account Types | Explorer Account – $500

Pioneer Account – $10,000 Master Account – $25,000 VIT Account – $50,000 |

| Contact Information | Email: [email protected] (No phone or live chat) |

Red Flags in the Broker’s Offer:

- Leverage is undisclosed, which is unusual and a major red flag.

- High minimum deposits—asking for $10,000+ for premium accounts is excessive.

- Limited contact methods—only an email, no phone number or live chat.

This setup is typical of high-risk brokers who aim to extract large deposits without providing real support.

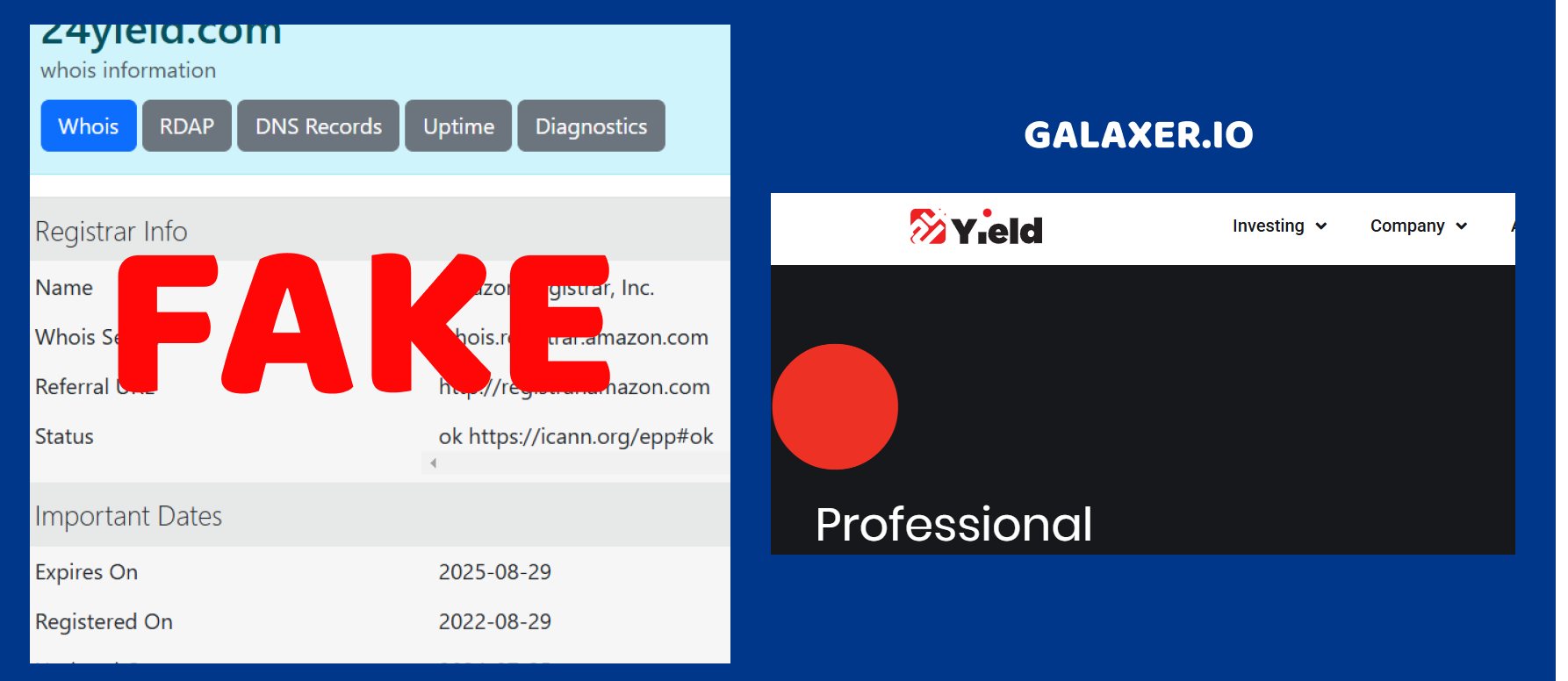

24 Yield Scam Investigation: Domain Creation Date

One of the first things we checked about 24 Yield was the timeline of its existence. And what did we find? A classic red flag.

The company claims to have been established in 2020, meaning they want you to believe they’ve been around for a while, building trust and credibility. But when did they actually buy their domain? August 29, 2022.

Now, let’s think about this. Why would a broker, supposedly operating since 2020, wait two years before purchasing their own website? A legitimate financial firm would need an online presence from day one. This inconsistency suggests either:

- They were lying about their founding date to appear more experienced than they really are.

- They operated under a different name before 2022 and possibly rebranded—often a tactic used by scammers trying to escape bad reviews.

Either way, something doesn’t add up. A serious financial institution wouldn’t have such gaps in its history. Honest businesses don’t need to manipulate their timeline—only fraudsters do.

24 Yield Scam Investigation: Fake License

Another major red flag for 24 Yield is its so-called “regulation.” According to their claims, they are regulated by FSC (Financial Services Commission). At first glance, this might sound legitimate—but here’s the issue.

Not all FSCs are the same. Many scam brokers register under weak or offshore financial regulators that offer zero protection for traders. Real regulatory bodies—like the FCA (UK) or ASIC (Australia)—have strict rules, require transparency, and actively protect investors.

However, 24 Yield’s license is classified as “The license cannot be trusted.” This means:

- The regulator has no real enforcement power.

- There is no compensation scheme if they steal your money.

- Scam brokers often use FSC-type regulators because they are cheap and require almost no oversight.

A trustworthy broker will proudly display a verifiable license from a strict financial authority. 24 Yield, on the other hand, hides behind a questionable regulatory body, making it clear they operate in a high-risk, unregulated environment.

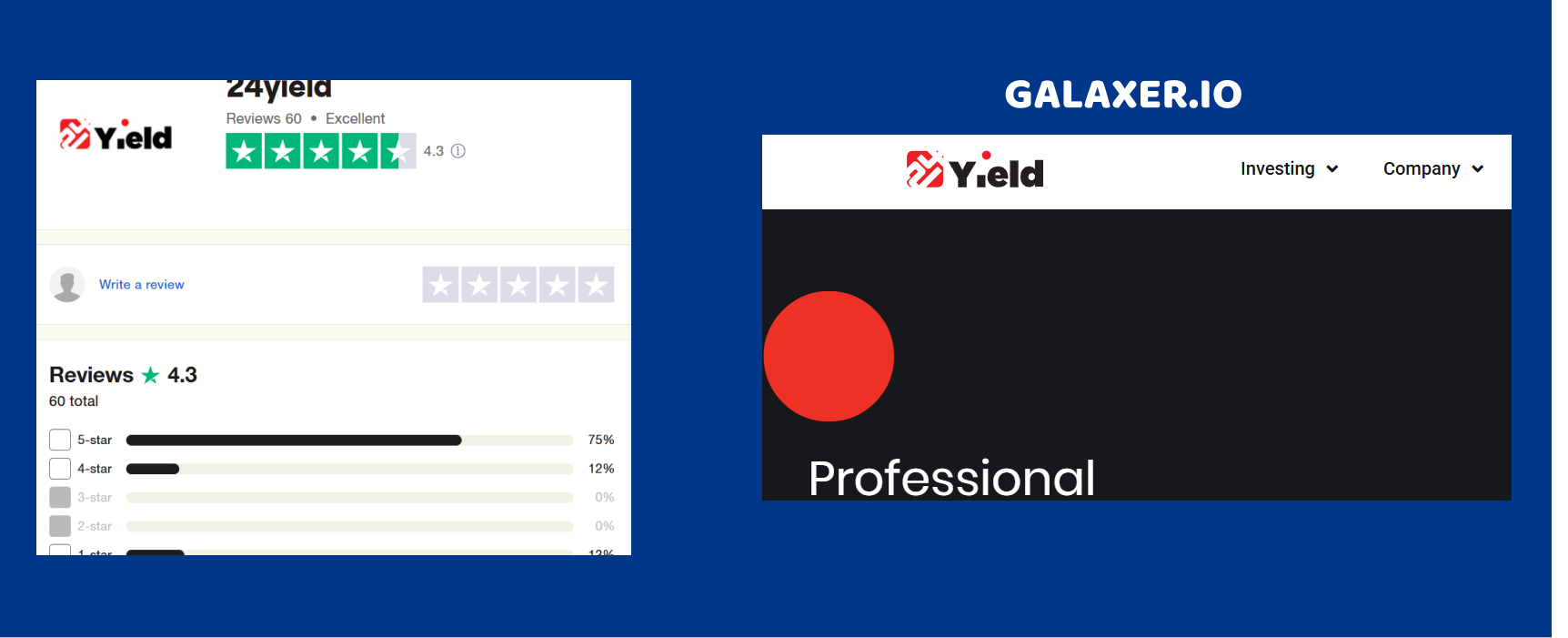

24 Yield Scam Investigation: Suspicious Trustpilot Reviews

At first glance, 24 Yield seems to have a decent Trustpilot score of 4.3 with 60 reviews. But don’t let that number fool you—when we looked closer, we found classic signs of fake reviews and reputation manipulation.

Here’s what stood out:

- Too many generic, overly positive reviews – Scammers love to flood Trustpilot with fake five-star reviews, often written in the same style, with vague praise like “great platform,” “fast withdrawals,” or “best broker ever.” Real traders usually give more detailed experiences.

- Low number of bad reviews – Only 8 negative reviews? That’s suspiciously low. Most brokers—especially ones dealing with real customers—always have more complaints about withdrawals, spreads, or customer service. The fact that bad reviews are minimal suggests they are being buried or removed.

- Trustpilot rating inflation – A score of 4.3 sounds impressive, but when a broker has fake positive reviews outweighing real customer complaints, the actual user experience is likely much worse.

Honest brokers don’t need to manipulate their ratings—their service speaks for itself. 24 Yield, on the other hand, relies on artificial reputation boosting, which is a major red flag.

24 Yield – A Carefully Disguised Scam?

After diving deep into 24 Yield, the verdict is clear—this broker is loaded with red flags. Everything about them screams manipulation and deception rather than a legitimate trading firm.

🔴 Fake History – They claim to have been established in 2020, but their domain was only purchased in August 2022. Why would a real broker operate for two years without an official website? Either they lied about their founding date or rebranded from a previous scam.

🔴 Untrustworthy Regulation – They flaunt an FSC license, but here’s the catch: it’s not a strict financial regulator. This means there’s no real oversight, no client protection, and no compensation scheme if they steal your money.

🔴 Suspicious Reviews – A 4.3 Trustpilot score might seem good, but when a broker buries bad reviews under fake positive ones, you know something is off. The pattern of generic five-star ratings suggests review manipulation.

🔴 Shady Account Structure – Demanding $10,000+ for higher-tier accounts is excessive, especially when they don’t even disclose leverage. Legitimate brokers provide clear, transparent conditions—scam brokers, on the other hand, hide key details and lure traders into depositing more.

🔴 Minimal Contact Information – Only an email? No phone number, no office address, no live chat? Real brokers provide multiple ways to reach them. Scam brokers stay as anonymous as possible—so when they disappear with your money, you can’t find them.

Final Verdict: Avoid 24 Yield at All Costs

24 Yield follows the classic scam broker formula—fake history, unreliable licensing, manipulated reviews, and vague trading conditions. The entire operation is designed to take deposits from traders and vanish when withdrawals are requested.

If you’re looking for a safe, regulated broker, 24 Yield is NOT the place to trade. Stay away before it’s too late. 🚨