Finaguide Review – Scam or Legit Broker?

When looking for a reliable broker, regulation, transparency, and trader feedback are key. But what happens when a broker hides its true identity, manipulates reviews, and operates without a license? That’s exactly the case with Finaguide.

At first glance, their website looks polished, promising secure trading, advanced platforms, and multiple account options. But the deeper we investigated, the more red flags appeared—false claims, shady business practices, and a complete lack of regulation.

Is Finaguide a legitimate broker, or just another scam designed to steal your money? We’ve broken down the facts to expose the truth. Let’s dive in.

Finaguide: General Broker Information

To give you a clear picture of what Finaguide offers (or pretends to offer), here’s a breakdown of their platform, trading conditions, and contact details. But remember—just because they list these features doesn’t mean they actually provide them.

| Category | Details |

| Website Domain | finaguide.com |

| Established Year | 2020 (but domain bought in 2021) |

| Regulation | ❌ Not regulated (operates illegally) |

| License Type | ❌ No license (trading is unsafe) |

| Platforms | Web Terminal, Android, iPhone & iPad |

| Leverage | 🚫 No information provided (high risk) |

| Account Types | – Beginner – $2500

– Standard – $5000 – Intermediate – $10,000 – Advanced – $25,000 |

| Restricted Countries | 🚫 No information given (shady) |

| Trustpilot Score | ⚠️ 2.6 (Extremely low) |

| Total Reviews | 42 (with 16 bad reviews) |

| Contact Info | 📧 [email protected]

📞 +18009516353 |

Suspicious Elements in Finaguide’s Offering

- 🚩 High Minimum Deposits – Even the “Beginner” account requires a whopping $2,500. Most legitimate brokers allow traders to start with $50–$250. This is a classic scam strategy: demand huge deposits upfront before victims realize they’ve been tricked.

- 🚩 No Regulatory Oversight – Without a valid license, they can change terms, block accounts, or manipulate trades at any time.

- 🚩 No Leverage Information – A real broker is transparent about leverage, as it’s a crucial factor for traders. The fact that Finaguide hides this suggests they’re manipulating trading conditions behind the scenes.

- 🚩 No Clear Withdrawal Policy – Scam brokers often make it easy to deposit but impossible to withdraw. Multiple reviews suggest Finaguide does exactly that.

Final Thought

Finaguide presents itself as a professional broker, but the lack of regulation, high deposit requirements, and bad reviews scream SCAM. If you’re considering them—run in the opposite direction.

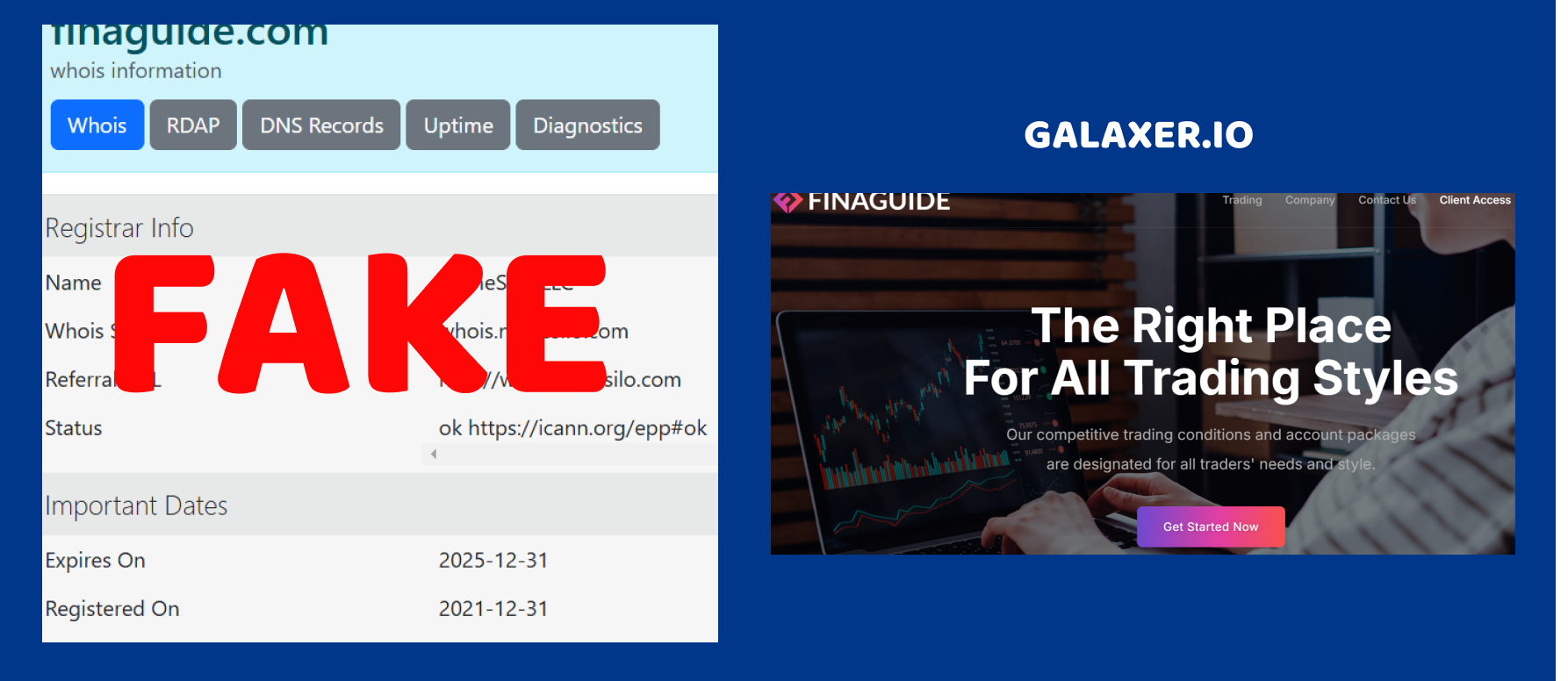

Finaguide Scam Investigation: Domain Registration Date

One of the first red flags when analyzing Finaguide is the domain registration date. Their website finaguide.com was bought on December 31, 2021, but the company claims to have been established in 2020. See the problem?

A legitimate broker with real operations in 2020 would have needed an official online presence back then. Why would a company wait an entire year before securing their domain? It just doesn’t add up.

This kind of inconsistency is a classic sign of a hastily put-together scam. The website was likely created after the scammers already started operating, possibly because their previous site was exposed or blacklisted.

And let’s be honest—no real financial institution would delay setting up its website for a whole year. The internet is the backbone of modern trading platforms, and any serious broker would have launched their site before attracting clients, not after.

So, what’s the real story behind Finaguide? From the looks of it, they popped up out of nowhere with a fabricated history. That’s a strong warning sign for anyone considering trusting them with their money.

Finaguide Scam Investigation: Fake or Non-Existent License

If you’re looking for a properly regulated broker, Finaguide should not even be on your list. Why? Because they don’t have a license—at all.

Regulation Status: “Without License”

Our investigation confirmed that Finaguide operates without any financial regulatory approval. They claim to be a trading platform, yet they lack oversight from ANY respected regulatory body. No FCA (UK), CySEC (Cyprus), ASIC (Australia), or even offshore entities like FSA (Seychelles)—nothing.

What does this mean for traders? Essentially, if Finaguide decides to freeze your account, deny withdrawals, or manipulate trades, there is no authority to hold them accountable. No legal protection. No investor compensation fund. Just an empty promise from a company that can disappear at any moment.

Why Would a “Real” Broker Avoid Regulation?

Legitimate brokers spend months, even years, securing licenses. It’s a long, expensive process that ensures transparency and security for traders. But Finaguide? They skipped all of that.

And let’s ask the obvious: why would a legitimate company avoid getting licensed? The answer is simple—because regulation means following strict rules, and scammers don’t like rules.

What Happens If You Trade with an Unlicensed Broker?

- Your deposits are at risk—they can vanish overnight.

- There’s no legal recourse if they steal your funds.

- They can manipulate spreads, stop-losses, and withdrawals without consequences.

- Many scammers shut down and rebrand under a different name once exposed.

In short, dealing with an unlicensed broker is like giving your money to a stranger on the street and hoping they’ll return it later. It just doesn’t work that way.

If Finaguide were a legitimate broker, they would be regulated. The fact that they aren’t? That tells you everything you need to know.

Finaguide Scam Investigation: Fake & Manipulated Reviews

If you’re wondering whether Finaguide is trustworthy, just take a look at what traders are saying. Spoiler alert: it’s not good.

Trustpilot Rating: 2.6 – A Disaster for a Broker

Finaguide has a Trustpilot score of just 2.6, which is a massive red flag. For comparison, even average brokers with minor issues usually maintain a rating above 3.5. A score this low means a high number of complaints and negative experiences.

And it gets worse. Out of 42 total reviews, 16 are categorized as “bad”—meaning nearly 40% of reviewers had such a terrible experience that they had to warn others.

The Classic Fake Review Strategy

A closer look at the reviews shows another common scam tactic—review manipulation.

Here’s what we found:

- Negative reviews describe the same issues: withdrawal refusals, account restrictions, and unresponsive customer support.

- Positive reviews look suspiciously similar in wording, often lacking details about actual trading experiences.

- Most positive reviews are from new accounts, which suggests they were likely paid for or self-written by scammers.

If Finaguide were truly a great broker, wouldn’t real traders leave detailed, positive feedback? Instead, the reviews look like a hastily assembled damage-control operation—a mix of genuine complaints and fake praises meant to mislead potential victims.

What Do Real Traders Say?

Some of the most alarming reviews include:

- “They blocked my account when I tried to withdraw my profits. Support stopped replying.”

- “They keep asking for more money before I can withdraw. Total scam!”

- “Spreads and fees keep changing randomly. Feels rigged.”

Sounds familiar? These are the exact same complaints we see with countless scam brokers. Finaguide is no different.

Bottom Line? Trust the Bad Reviews.

If almost half of a broker’s reviews warn people to stay away, there’s only one smart choice—listen to them. The real traders who lost money aren’t lying, but the scammers posting fake 5-star reviews? They definitely are.

Final Verdict: Finaguide is a Scam

After thoroughly investigating Finaguide, the conclusion is crystal clear—this is not a legitimate broker. Everything about this company raises red flags, from its fake establishment date to its nonexistent regulation, manipulative reviews, and high-risk trading conditions.

Key Reasons to Avoid Finaguide:

- ❌ Fake Establishment Year – Claims to be from 2020, but the website domain was only bought in late 2021.

- ❌ No Regulation or License – They operate illegally, meaning your funds are completely unprotected.

- ❌ Terrible Reviews (2.6 on Trustpilot) – Almost 40% of traders warn that they lost money due to withdrawal issues and shady practices.

- ❌ High Minimum Deposit ($2,500+ for the lowest account) – Legitimate brokers offer accounts starting from $50-$250, not thousands.

- ❌ No Transparency on Trading Conditions – No leverage details, hidden fees, and likely price manipulation.

So, What Happens If You Deposit Money?

Simple: you won’t get it back. Finaguide operates like every other scam broker—they lure traders in, take their money, and block withdrawal requests. The positive reviews? Likely fake. The regulation? Nonexistent.

The Safe Move? Stay Away.

If you’re serious about trading, choose a regulated broker under FCA, ASIC, CySEC, or another reputable authority. Finaguide is just another fraudulent platform designed to steal your money before vanishing and rebranding under a new name.

Don’t fall for it. Avoid Finaguide at all costs.