Cinpax Review – Is This Broker a Scam?

If you’ve been searching for a reliable broker, you might have come across Cinpax. On the surface, they present themselves as a professional trading platform with multiple account types and high leverage. But here’s the real question—can they actually be trusted?

When we started digging into Cinpax, we found red flags everywhere. From their lack of regulation to suspicious Trustpilot reviews and discrepancies in their founding date, everything points to one conclusion—this broker is not as legitimate as they want you to believe.

So, is Cinpax a trustworthy broker or just another scam? Let’s break it all down and see why you should think twice before investing your money here.

Cinpax Review – General Information About the Broker

Here’s a complete breakdown of what we found about Cinpax. Take a look at the details, and you’ll see why this broker raises more questions than answers.

| Category | Details |

| Website | cinpax.com |

| Platforms | Web Trading, Android, iPhone/iPad |

| Leverage | 1:400 |

| Account Types | Starter – $250, Basic – $2,500, Advanced – $25,000, Pro – $100,000 |

| Restricted Countries | U.S., Iran, North Korea |

| Regulation | Unregulated (No license) |

| Trustpilot Score | 2.1 (Very Low) |

| Total Reviews | 20 (11 are negative) |

| Domain Registration Date | August 10, 2018 (Yet they claim to be active since 2017) |

| Contacts | Tel: +18009851351, Mail: [email protected] |

🔎 Key Concerns

- Unregulated Broker – No oversight, meaning traders have zero protection if things go wrong.

- Fake Establishment Date – They claim to be active since 2017, but their domain was only bought in 2018.

- High Leverage (1:400) – Designed to encourage high-risk trading, often a tactic of shady brokers.

- Suspicious Trustpilot Reviews – Low score (2.1), with withdrawal issues being the biggest complaint.

So, if you’re thinking of investing with Cinpax, ask yourself—why would you trust a broker with no license, a bad reputation, and a history of misleading information?

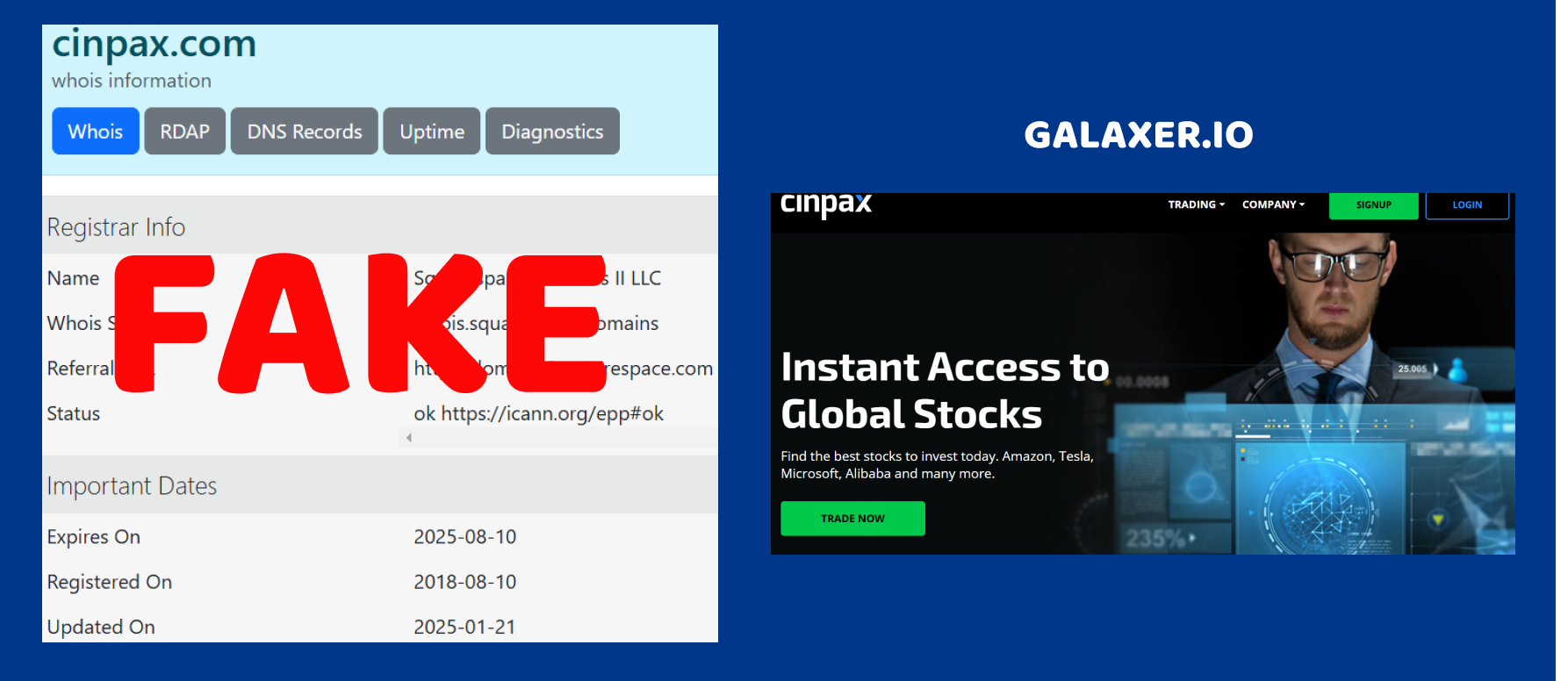

Cinpax Review – Date of Domain Registration (Argument 1)

Now, here’s where things start getting interesting. Cinpax claims to have been established in 2017, which might make it seem like a reliable and long-standing broker. But let’s dig deeper—when was their domain actually registered? August 10, 2018.

So what’s the issue? Well, if the broker was supposedly founded in 2017, why did they only register their website in mid-2018? One could argue that they initially operated offline or under a different domain, but let’s be honest—what modern broker doesn’t set up a website right away?

This kind of discrepancy is a red flag. It suggests that the company might have backdated their “establishment” date to appear more credible. Why? Because traders generally prefer brokers with a longer history, assuming they are more trustworthy. But this inconsistency raises an important question—what else are they not being truthful about?

And trust me, this is just the beginning of what’s off with Cinpax.

Cinpax Review – License and Regulation (Argument 2)

Now let’s talk about one of the most critical aspects of any broker—regulation. If you’ve been in the trading space for a while, you already know that a license from a reputable financial authority is a must-have. It protects traders from fraud, ensures fair practices, and holds the broker accountable. So, what’s the deal with Cinpax?

Well, they don’t have a license at all. That’s right—Cinpax operates without any regulatory oversight. They don’t hold a license from the FCA (UK), ASIC (Australia), CySEC (Cyprus), or even an offshore regulator like IFSC (Belize). Instead, they try to sweep this under the rug, hoping traders won’t notice.

Let’s be real—why would any legitimate broker choose to operate without regulation? The only possible reason is that they don’t want to be monitored. No audits, no compliance with investor protection laws, and no legal responsibility if something goes wrong. If Cinpax decides to disappear overnight with client funds, there’s no authority to hold them accountable.

But here’s where it gets even worse—Cinpax restricts traders from countries like the U.S., Iran, and North Korea. This suggests that they know operating in those jurisdictions without a proper license would get them shut down immediately. Yet, they have no problem accepting clients from other countries where regulations are weaker or enforcement is slow.

So, let’s ask the obvious question—would you trust your money with an unregulated broker that can do whatever they want with your funds? Because that’s exactly the risk traders take when dealing with Cinpax.

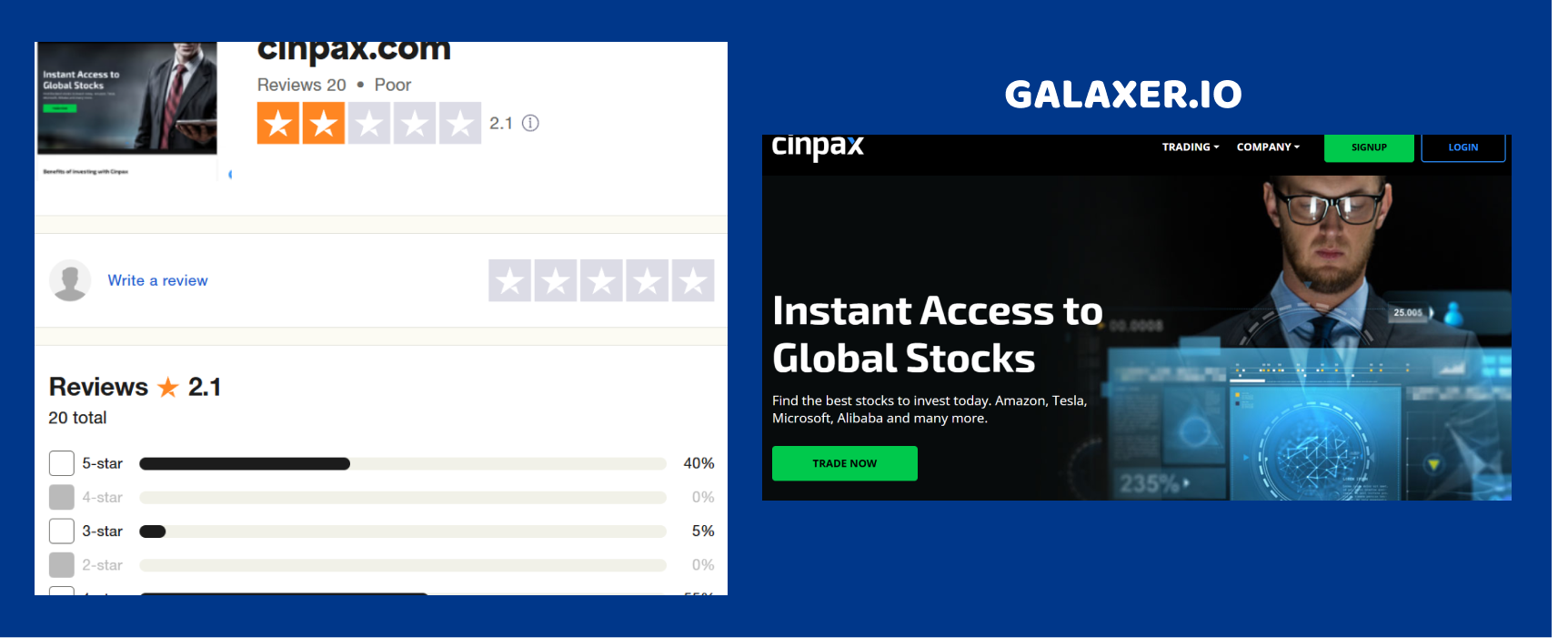

Cinpax Review – Trustpilot Reviews (Argument 3)

Now, let’s take a look at what real traders are saying about Cinpax. If a broker is truly reliable, its reputation should reflect that, right? Well, Cinpax’s Trustpilot score is a miserable 2.1. And when we dug deeper, the situation looked even worse.

Out of the 20 total reviews, 11 are bad. That’s more than half of the reviewers warning others about scams, withdrawal issues, and shady tactics. And what about the positive reviews? They look suspiciously fake—short, generic, and written in the same style. Classic review manipulation.

🚨 Red Flags in the Reviews:

- Traders Can’t Withdraw Funds – The most common complaint. Users report that as soon as they try to withdraw money, the broker either stops responding or asks for extra fees before releasing the funds (which never happens).

- High-Pressure Tactics – Many negative reviews mention that Cinpax representatives push traders to deposit more money, promising guaranteed profits. Once the trader refuses or asks for a withdrawal, the account is suddenly blocked.

- Fake Positive Reviews – The few 5-star ratings are vague, generic, and look artificially boosted to balance out the overwhelmingly negative feedback. Legitimate brokers don’t need to fake their reputation.

- Manipulated Trades – Some users report that their trades were mysteriously closed at a loss, with no explanation. Suspicious, right?

So, What’s the Verdict?

Cinpax’s Trustpilot reviews paint a clear picture of a scam broker. Real traders are exposing their shady tactics, while the broker desperately tries to cover it up with fake reviews. If they were truly reliable, why would so many users be complaining about the same issues—withdrawal problems, manipulation, and aggressive sales tactics?

Would you trust a broker with this kind of reputation? Probably not.

Final Verdict – Is Cinpax a Scam?

After analyzing all the details, the answer is clear—Cinpax is a highly suspicious broker, and traders should stay away. Here’s why:

- No License, No Oversight – They operate completely unregulated, which means there’s no authority to protect your funds if things go wrong.

- Fake Establishment Date – They claim to be active since 2017, yet their domain was only registered in 2018. Why lie about something so simple?

- Terrible Reputation – With a 2.1 Trustpilot rating, more than half of the reviews are negative, warning about withdrawal issues, high-pressure tactics, and account manipulation.

- High-Risk Trading Conditions – Offering 1:400 leverage without proper regulation is a clear tactic to encourage reckless trading, which benefits the broker—not the trader.

At the end of the day, Cinpax shows all the signs of a scam operation. The lack of regulation alone should be enough to raise alarms, but combined with fake reviews, misleading information, and withdrawal complaints, it’s clear that this is not a broker you can trust.

Would you really risk your money with a company that has so many red flags? There are plenty of regulated, transparent brokers out there—Cinpax is not one of them.