Cap Place Review – Is This Broker Hiding Something?

When choosing a broker, transparency and trustworthiness are everything. After all, you’re putting your hard-earned money into their hands. But what if a broker’s history doesn’t quite add up? That’s exactly the case with Cap Place, a company that raises more questions than it answers.

At first glance, Cap Place presents itself as an experienced broker with a solid reputation. But after a deep dive into its background, we found major inconsistencies—from a questionable regulatory status to suspicious online reviews. And let’s not forget the strange discrepancy in its founding date.

So, is Cap Place a legit broker or just another offshore trap? Let’s break down the facts.

Cap Place – General Information

Here’s a breakdown of the key details about Cap Place:

| Category | Details |

| Website Domain | No data available |

| Established Year | 2004 |

| Date of Domain Purchase | March 2, 2006 |

| Regulation | M.I.S.A (Weak offshore regulator) |

| License Type | Cannot be trusted |

| Trustpilot Score | 4.2 (38 reviews, 9 negative) |

| Leverage | No data available |

| Types of Accounts | No information provided |

| Restricted Countries | No data available |

| Platforms | No information provided |

| Contacts | No contact details available |

Key Red Flags:

- Offshore Regulation (M.I.S.A) – This means zero real oversight or protection for traders.

- Fake Trustpilot Reviews – Suspiciously positive ratings despite a high percentage of negative feedback.

- Lack of Transparency – Missing key trading details like leverage, account types, and platform information.

- Inconsistent History – Claims to be established in 2004, yet the domain was only bought in 2006.

Legitimate brokers always provide clear and verifiable details about their services. The fact that Cap Place lacks so much basic information is a huge warning sign.

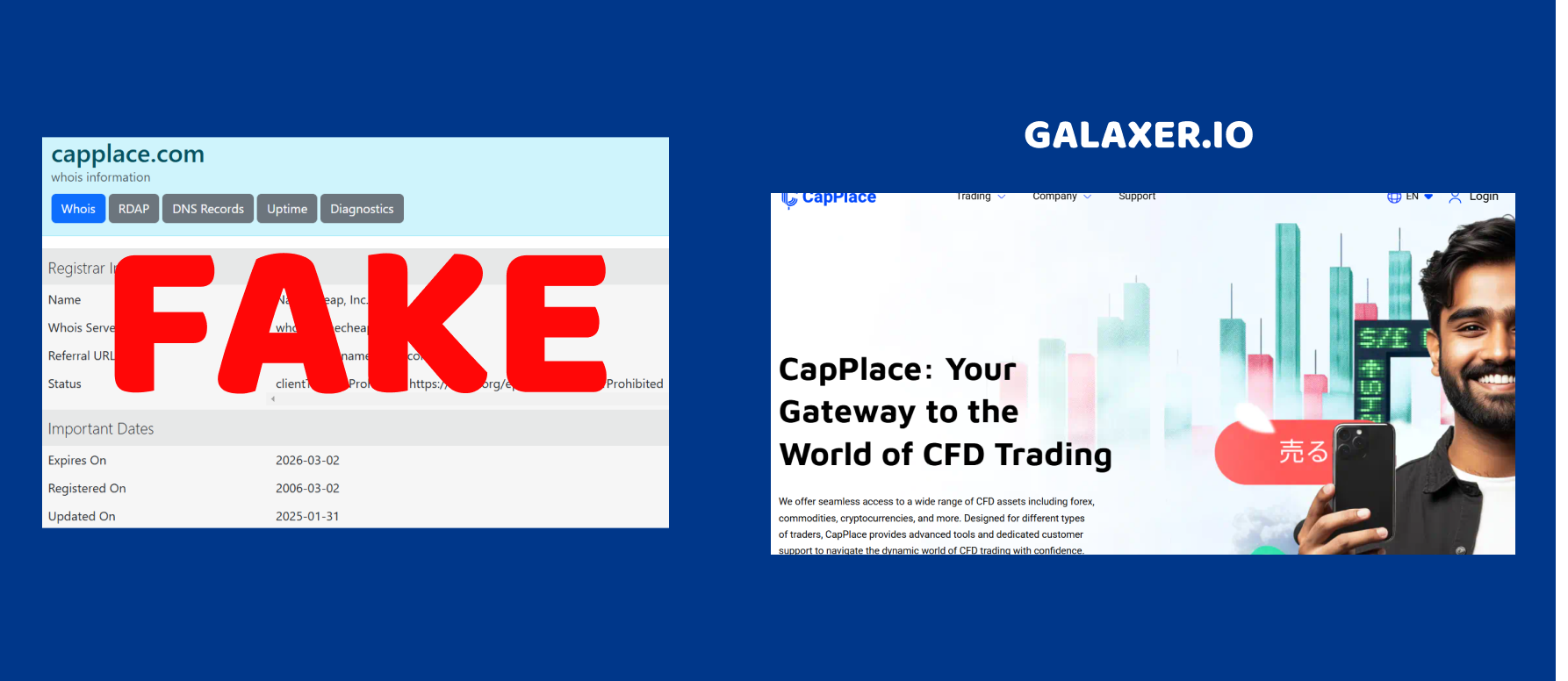

Cap Place – Date of Creation (Argument 1)

At first glance, Cap Place might seem like a well-established broker, boasting a foundation year of 2004. A company with such a long history should, in theory, inspire confidence, right? But here’s where things get suspicious.

After checking the domain purchase date, something doesn’t quite add up. The domain for Cap Place was only bought on March 2, 2006—two years after the company supposedly started operations.

Now, let’s think logically. A legitimate broker would need an online presence from the beginning, especially in the modern financial world. So why would a broker claiming to have been around since 2004 only secure its domain in 2006? Were they operating without a website for two years? Unlikely.

This mismatch raises a serious red flag. It suggests that the company might have fabricated its founding date to appear more reputable than it really is. This is a classic tactic used by fraudulent brokers to build fake credibility and lure in unsuspecting investors.

And if they are misleading about their history, what else could they be hiding?

Cap Place – License & Regulation (Argument 2)

Regulation is one of the most critical aspects of any broker’s credibility. If a company operates under a strong financial authority, it provides a layer of protection for traders. But what happens when a broker’s license is questionable? That’s exactly what we found with Cap Place.

Cap Place is supposedly regulated by M.I.S.A (Mwali International Services Authority). If you’ve never heard of it, you’re not alone. M.I.S.A. is a notoriously weak offshore regulator that offers little to no oversight. Brokers registered under M.I.S.A. can essentially do whatever they want—meaning your money is far from safe.

Even worse, our analysis confirms that the license for Cap Place “cannot be trusted”. This is a major warning sign. Why? Because scam brokers often use offshore regulators like M.I.S.A. precisely because they don’t enforce strict financial rules. This allows them to operate without real accountability, making it easier to manipulate prices, refuse withdrawals, and vanish with investors’ funds.

A legitimate broker would hold a license from trusted regulators like FCA (UK), ASIC (Australia), or CySEC (Cyprus). Instead, Cap Place has opted for a license that offers zero real protection for its clients.

Ask yourself this: why would a legitimate company choose a weak, offshore regulator instead of a trusted financial authority? The answer is simple—they wouldn’t. This is a clear attempt to appear “regulated” while avoiding any real oversight.

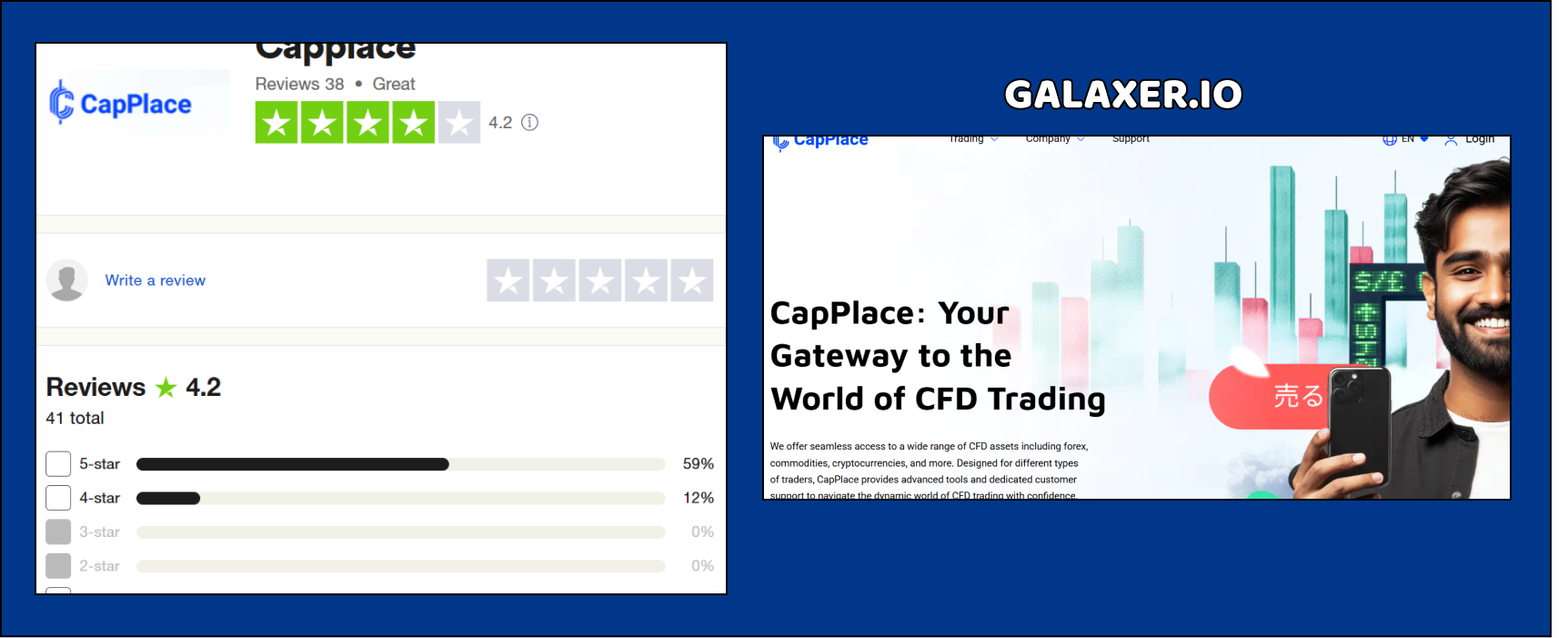

Cap Place – Reviews & Trustpilot Rating (Argument 3)

At first glance, Cap Place has a 4.2-star rating on Trustpilot, which might seem decent. But don’t let the numbers fool you—this is where things get interesting.

First, the broker has only 38 total reviews. That’s an incredibly low number for a company claiming to be in business since 2004. A legitimate broker with years of experience should have hundreds, if not thousands, of reviews. The lack of genuine user feedback is a red flag.

Now, let’s dig deeper. Out of these 38 reviews, 9 are negative. That means almost 25% of reviewers had a bad experience—a very high percentage for a so-called “trusted” broker. But what about the positive reviews?

Suspiciously, many of the 5-star reviews follow a similar writing pattern, which strongly suggests they were written by fake accounts. Common signs of review manipulation include:

- Generic praise with no real details about trading experience.

- Overuse of buzzwords like “amazing profits” or “best broker ever.”

- Short, vague testimonials that don’t mention specific features or issues.

Fake reviews are a classic tactic used by scam brokers to cover up negative feedback and boost their ratings. When combined with the low number of reviews and a high percentage of complaints, it’s clear that Cap Place’s reputation isn’t as strong as they want you to believe.

If a broker is truly reliable, they won’t need to manipulate reviews or suppress negative feedback. Instead, their long-term clients will naturally leave positive testimonials. But in Cap Place’s case, the numbers just don’t add up.

Final Verdict – Is Cap Place a Scam?

After thoroughly analyzing Cap Place, it’s clear that this broker has more red flags than trust signals. The evidence speaks for itself:

🚩 Inconsistent History – The company claims to be established in 2004, yet its domain was only purchased in 2006. Why the gap? Fabricating a founding date is a classic trick used by scammers to appear more reputable.

🚩 Untrustworthy Regulation – Cap Place operates under M.I.S.A., a weak offshore regulator that provides zero real protection for traders. A genuine broker would be licensed by FCA, ASIC, or CySEC, not a regulatory loophole.

🚩 Suspicious Reviews – While the Trustpilot score appears decent at 4.2, a closer look reveals only 38 total reviews, with almost 25% being negative. Even worse, the positive reviews seem fake and repetitive, suggesting review manipulation.

🚩 Lack of Transparency – No clear details on trading platforms, account types, or even basic contact information. A legitimate broker doesn’t hide essential information.

Should You Trust Cap Place?

Absolutely not. Everything about this broker screams high risk. From its shady regulatory status to its questionable online reputation, there’s little reason to believe Cap Place is a trustworthy trading platform.

If you value your money and security, stay away. There are far better, regulated brokers that offer transparency, proper oversight, and real client protection. Don’t fall for the illusion—Cap Place is just another offshore broker that isn’t worth the risk.