Turf Capital Private Review – Another Forex Scam in Disguise?

The forex industry is full of shady brokers, but some try harder than others to hide their true nature. Turf Capital Private presents itself as a legitimate trading platform, supposedly operating since 2008. However, when we started digging deeper, the red flags became impossible to ignore.

A broker with no regulation, no reviews, and a domain registered only in December 2024—does that sound like a company with 16 years of experience? Or does it look more like a freshly created scam trying to lure in unsuspecting traders?

In this review, we’ll break down everything you need to know about Turf Capital Private and why trusting them could be a costly mistake.

Turf Capital Private – General Information

Here’s a breakdown of the key details about Turf Capital Private, based on our analysis:

| Category | Details |

| Website Domain | turfcapprivate.com |

| Established Year | Claims 2008, but domain registered in Dec 2024 (Contradiction) |

| Regulation | No license (Unregulated) |

| Leverage | 1:500 (Extremely risky) |

| Trading Platforms | No information provided |

| Account Types | Forex + Cryptocurrency – €100

Commodities – €100 |

| Restricted Countries | No information provided |

| Trustpilot Score | No reviews available |

| Contacts | No contact details provided |

🚩 Key Red Flags:

- Domain registered only in December 2024, contradicting their “since 2008” claim.

- Completely unregulated, meaning zero investor protection.

- No trading platform information, which is extremely unusual for a broker.

- No reviews or trader feedback anywhere, a major sign of a potential scam.

- No disclosed contact details, making it impossible to reach them if issues arise.

With no regulation, no track record, and no transparency, Turf Capital Private is looking more and more like a typical forex scam operation.

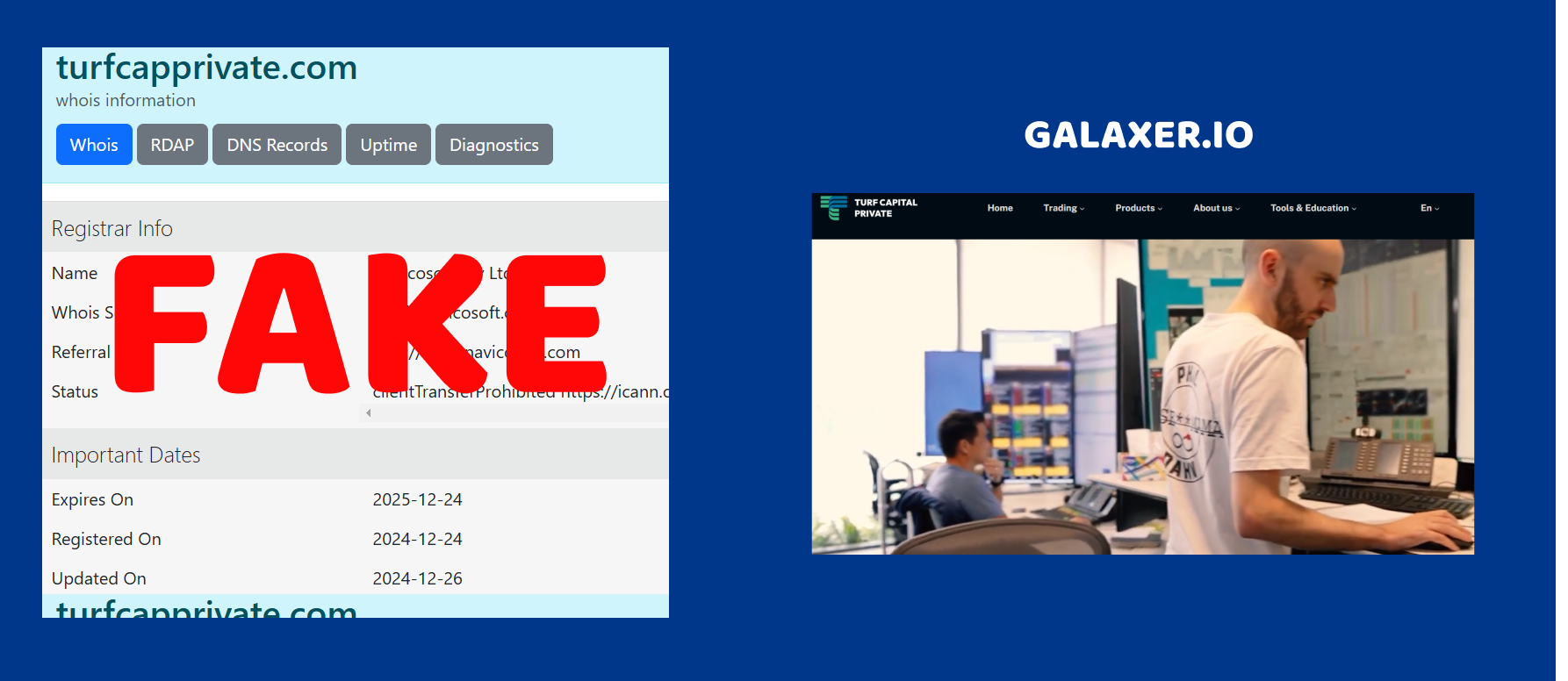

Turf Capital Private Review – Suspicious Domain Registration Date

When we started analyzing Turf Capital Private, one major red flag popped up almost immediately—its domain registration date. The company claims to have been established in 2008, but their domain was only registered on December 24, 2024.

Wait a minute—how is that even possible? A broker supposedly operating since 2008 should have an older, long-established domain. But here we have a situation where the domain didn’t even exist until the very end of 2024. That’s a clear contradiction and a classic trick used by scam brokers. They fabricate a long history to appear trustworthy, but their domain history betrays the lie.

Why would a legitimate company wait 16 years to register its own website? The answer is simple—they wouldn’t. This inconsistency suggests that Turf Capital Private is not what it claims to be. Instead, it’s likely a newly created fraudulent operation pretending to have years of experience.

And let’s not forget—fraudsters often use fresh domains to avoid being blacklisted. Once they get exposed, they abandon the site and create a new one under a different name. This could be yet another case of that scheme.

Bottom line? The domain date alone already raises serious doubts about the legitimacy of this broker. And from experience, when one red flag appears, more are sure to follow.

Turf Capital Private Review – Fake or Non-Existent License?

Regulation is the backbone of any trustworthy forex broker. A licensed broker is accountable to financial authorities, ensuring client protection. So, naturally, we checked what kind of license Turf Capital Private holds. The result? No license whatsoever.

Let’s be clear—this means zero oversight, zero protection, and zero guarantees that your money is safe. The broker is listed as “Without license”, meaning it operates entirely outside the jurisdiction of any reputable financial authority. This is the most dangerous category of brokers because they can manipulate trades, refuse withdrawals, and even disappear overnight with clients’ funds.

Now, ask yourself: Why would a “serious” forex broker avoid regulation? Obtaining a legitimate license from financial authorities like the FCA (UK), ASIC (Australia), or CySEC (Europe) is not an impossible task. It just requires transparency, adherence to rules, and proof of financial stability. But scammers? They avoid regulation like the plague—because it prevents them from scamming.

Some fraudsters try to cover their tracks by claiming to be registered under offshore regulators like M.I.S.A (Comoros) or FSA (St. Vincent & Grenadines). But Turf Capital Private doesn’t even bother with that. They simply operate without any regulation at all.

Without a license, clients have no legal way to get their money back in case of fraud. There are no governing bodies to report them to, and no regulatory pressure forcing them to process withdrawals.

If that doesn’t scream “run in the opposite direction,” I don’t know what does.

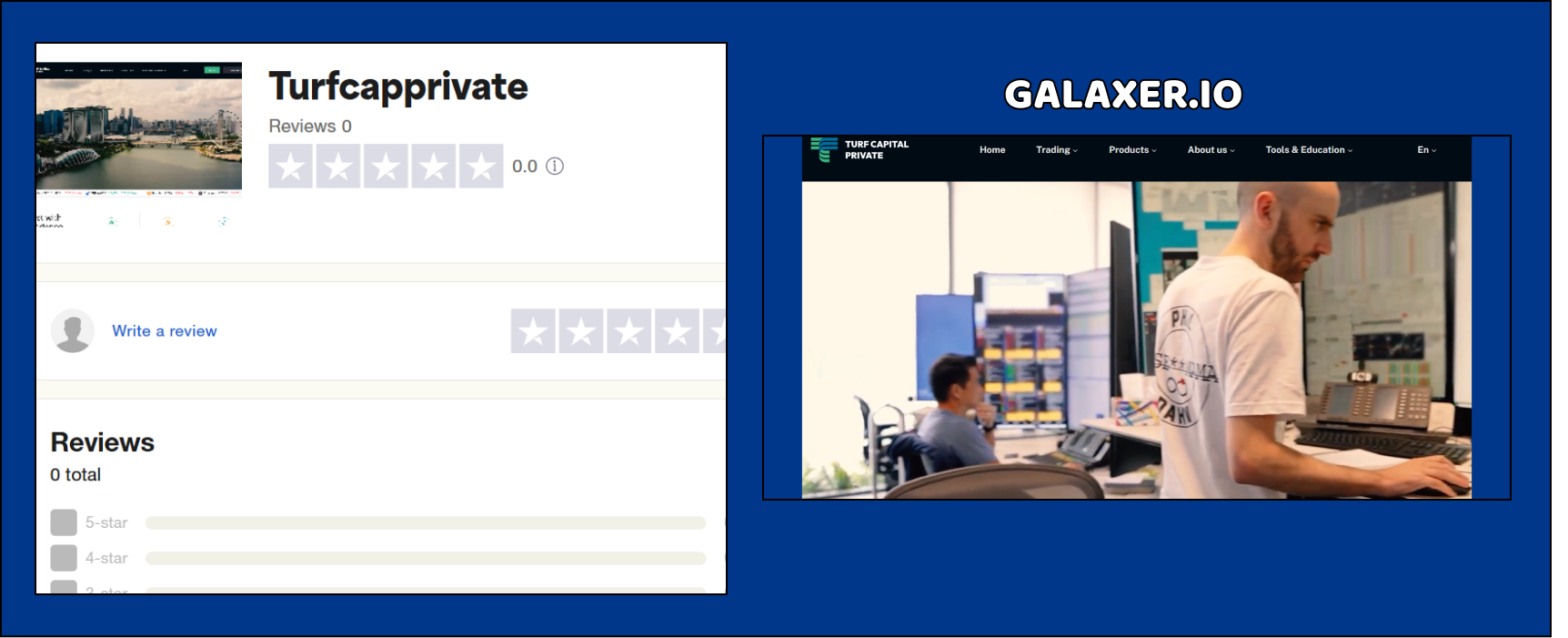

Turf Capital Private Review – Suspicious Lack of Reviews

When checking the credibility of any broker, reviews can tell us a lot. They reveal real traders’ experiences, potential scams, and whether a company follows fair business practices. So, we turned to Trustpilot and other review platforms to see what traders had to say about Turf Capital Private.

The result? No reviews at all.

Now, let’s think about this. Turf Capital Private claims to have been operating since 2008. That’s 16 years in the forex market, yet not a single trader has left a review? Not even a fake one? That’s practically unheard of. Even the worst scam brokers usually have some kind of online footprint—whether it’s negative complaints or artificially inflated positive reviews. But here, we have complete silence.

This raises two major concerns:

- The broker is brand new and lying about its history.

No real broker with 16 years of experience would be completely absent from review platforms. The most likely explanation is that Turf Capital Private is a newly created scam pretending to have a long history. - They delete or suppress negative feedback.

Another possibility is that traders have complained, but their reviews were removed. Some scam brokers go to great lengths to keep their reputation clean, using legal threats, paid content removal, or fake DMCA claims to silence critics.

A lack of reviews is just as suspicious as a flood of fake positive ones. It means there’s no transparency, no real client feedback, and no proof that this broker has ever successfully processed a withdrawal.

So, if you’re thinking about investing with Turf Capital Private, ask yourself: Would you trust your money to a broker with zero client feedback and no regulatory oversight?

Turf Capital Private Review – A Broker You Should Avoid

After a deep dive into Turf Capital Private, the evidence is overwhelming—this broker is not just suspicious; it’s a full-fledged scam.

🚩 Fake company history – Claims to have existed since 2008, yet its domain was only registered in December 2024. No legitimate broker would operate for 16 years without a website.

🚩 No regulation – Completely unlicensed, meaning there’s zero investor protection. They can manipulate trades, block withdrawals, or disappear with your funds without consequences.

🚩 No trader feedback – In all these supposed years of operation, there’s not a single review online. Either they just launched, or they delete negative reviews—both are bad signs.

🚩 No transparency – No information on trading platforms, real company address, or even proper contact details. A real broker provides full transparency, while scams try to stay hidden.

Final Verdict: Turf Capital Private is a Scam

Everything about this broker screams fraud. From the fabricated history to the lack of regulation and trader feedback, it’s clear that Turf Capital Private is just another unregulated forex scam. If you invest here, the chances of ever seeing your money again are next to zero.

Stay far away from Turf Capital Private, and if you’ve already deposited money, act fast—withdraw what you can before it’s too late.