Our Take on OQtima

OQtime is an up-and-coming financial derivatives broker that was established in 2022 and is already proving itself a reliable partner. The company is headquartered in Limassol, Cyprus, and serves international traders.

OQtima provides plenty of opportunities for copy and automated trading, incorporates a highly intuitive cTrader platform, and offers fairly competitive prices. I rated the broker caters to the needs of inexperienced newbies and seasoned professionals alike.

OQtima Pros and Cons

|

|

OQtima Highlights for 2024

- Transparent and Trustworthy. The broker is authorized by top-tier CySEC, adheres to most safety requirements, and operates on a ‘best execution’ principle.

- Competitive Prices. OQtima’s pricing mechanism features raw spreads and low fixed commissions that fall below the industry average.

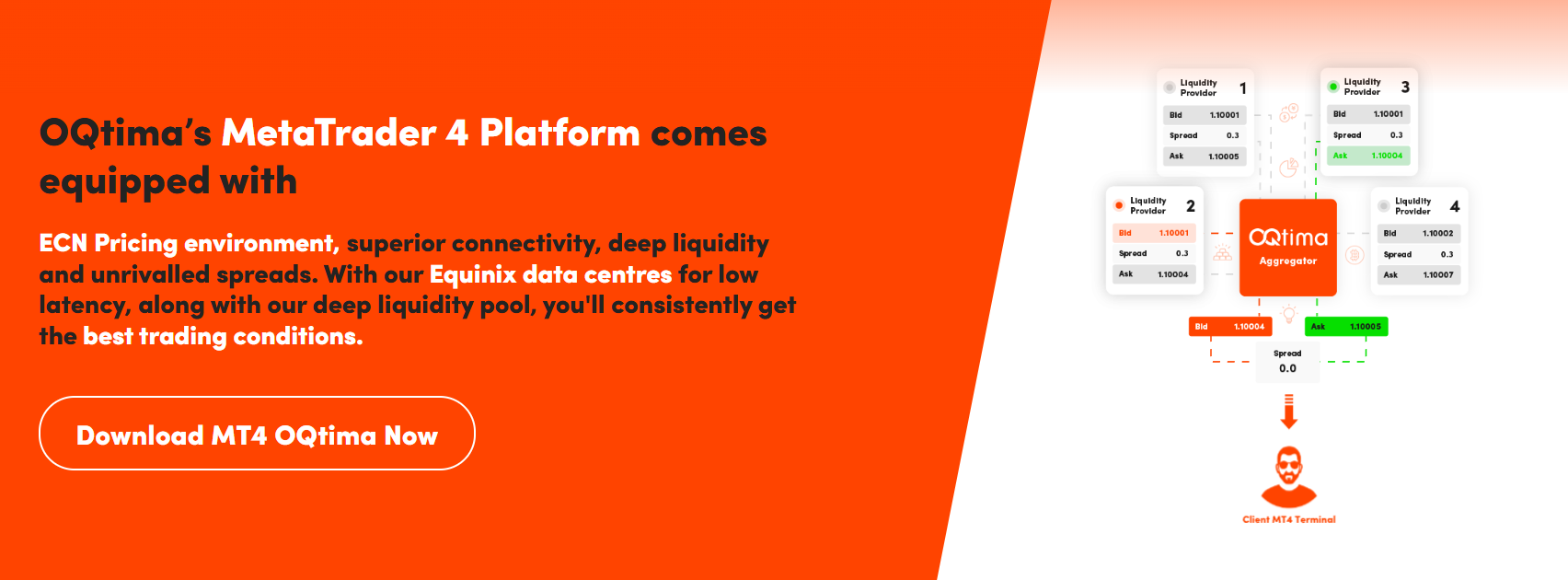

- Professional-Grade Platform. In addition to the popular MetaTrader 4 platform, OQtima incorporates cTrader, which is versatile and highly customizable.

- Fast Order Execution. The broker states that their average execution speed is less than 30 milliseconds, making OQtima one of the fastest brokers in the industry.

- Probing Research Content. Active clients with OQtima can access content from TradingCentral – one of the most trusted signal and analysis providers in the industry.

- Additional Features. The broker enables excellent conditions for copy and automated trading via cTrader. Moreover, OQtima offers VPS hosting.

Who is OQtima For?

After examining the different facets of OQtima’s general offering, I assessed that the broker is best suited for those interested in algorithmic trading. It incorporates the seamless cTrader platform, which has an excellent built-in tool helping traders automate their strategies.

Additionally, OQtima claims to support average execution speeds of under 30 milliseconds and provides VPS hosting. Fast execution speeds are necessary for precise entries and exits in and out of trades, which, in turn, is essential for the success of algorithmic trading.

Meanwhile, beginners can benefit from OQtima’s competitive trading fees and reliable customer support.

What Sets OQtima Apart?

OQtima offers 45 cryptocurrency CFDs, some of which are denominated in different currencies (USD, EUR, GBP). While not exclusive to OQtima, this extensive selection of crypto assets paired with multi-currency denominations is a relatively rare feature in the industry.

The major benefit of this multi-currency offering is the cost-saving advantage for crypto traders. They can choose to trade in cryptocurrencies denominated in their own base currency, like USD, EUR, or GBP. This choice allows them to avoid the extra costs associated with currency conversion, making their trading more efficient and cost-effective.

OQtima Main Features

| ☑️ Regulations | FSA (Seychelles), CySEC (Cyprus) |

| 🗺 Supported Languages |

English, Italian, Spanish, Portuguese, Chinese, Korean, French, Indonesian, Malaysian, Vietnamese, Japanese

|

| 💰 Products | Currencies, Stocks, Crypto, Indices, Commodities |

| 💵 Min Deposit | $20 |

| 💹 Max Leverage |

1:500 (FSA), 1:30 (CySEC)

|

| 🖥 Trading Desk Type | STP |

| 📊 Trading Platforms | MT4, cTrader |

| 💳 Deposit Options |

Wire Transfer, Skrill, Neteller, Credit Card, Debit Card

|

| 💳 Withdrawal Options |

Credit Card, Debit Card, Wire Transfer, Skrill, Neteller

|

| 🤴 Demo Account | Yes |

| 🗓 Foundation Year | 2022 |

| 🌎 Headquarters Country | Cyprus |

OQtima Full Review

Trust

OQtima Regulations

In our reviews, we examine the licenses and regulations of each entity operated by a broker. This allows us to compare their different levels of protection. We rank licenses by various regulatory bodies on a three-tier system, where Tier-1 licensing indicates the highest level of regulation.

This is what I discovered about OQtima:

- CDE Global Markets Ltd is licensed and regulated by the Financial Services Authority (FSA) in Seychelles with license number SD109. We rank the FSA as a Tier-3 regulator.

- Nordskov Capital Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 406/21. We rank CySEC as a Tier-1 regulator.

We have summarized the most essential aspects of OQtima in terms of regulation and safety in the table below:

| Entity Features | CDE Global Markets Ltd | Nordskov Capital Ltd |

| Country/Region | Seychelles, Eden Island | Cyprus, Limassol |

| Regulation | FSA | CySEC |

| Tier | 3 | 1 |

| Segregated Funds | Yes | Yes |

| Negative Balance Protection | Yes | Yes |

| Compensation Scheme | No | Up to EUR 20,000 under ICF |

| Maximum Leverage | 1:500 | 1:30 |

Why is it Important to Know Where Your Broker’s Subsidiaries are Regulated?

Brokers operate multiple entities because it allows them to serve clients worldwide. However, licenses obtained by regulators in different jurisdictions do not always entail the same degree of protection. Some regulators mandate compliance with the strictest financial frameworks, whereas others are less rigid. That is why traders need to familiarize themselves with the safety mechanisms ensured by the entity they want to open an account with beforehand.

Here is what you need to be looking for in a broker in terms of safety mechanisms:

- Segregation of client funds. Keeping client funds in segregated bank accounts from the ones used for the broker’s corporate capital negates the risk of accounting errors. OQtima’s two entities comply with this requirement.

- Negative balance protection. This safety mechanism removes the risk of trading losses exceeding the account balance. In other words, the losses you incur from trading are capped at the amount you have put in your trading account. This is especially important in volatile markets. Both entities ensure negative balance protection.

- Compensation scheme. A compensation scheme protects traders against the broker’s liabilities in the unlikely event that the company becomes insolvent. Clients of the CySEC-regulated entity, Nordskov Capital Ltd, are protected by up to EUR 20,000 under the Investor Compensation Fund (ICF). The Seychelles entity does not ensure a compensation scheme.

- Maximum leverage. Capping the maximum leverage restricts the extent of market exposure to retail traders. The higher the leverage, the higher the potential profits and potential losses. The maximum retail leverage with OQtima is 1:500, available with CDE Global Markets Ltd.

Is OQtima Safe to Trade With?

There are two subsidiaries operating under the OQtima brand name. One is regulated offshore (FSA), and the other by a European top-tier regulator (CySEC). The broker complies with some of the most stringent safety requirements in the industry, including the segregation of client funds and ensuring negative balance protection, with some minor exceptions.

It also has a ‘best execution policy’, meaning that it guarantees to deliver the most optimal price quotes under prevailing market conditions. Overall, I find the broker to be fairly safe to trade with.

Stability and Transparency

In our tests for the Trust category, we also cover factors relating to stability and transparency. Here, we focus on how long the broker has been in business, how big the company is, and how transparent it is in terms of readily available information.

What I really appreciated about OQtima is that there is a live spread feed on the website where traders can read about the minimum and average spread rates on different instruments across OQtima’s two account types. I compared these spread rates against the price quotes on the cTrader platform (for the ECN+ account type) and found them to be accurate.

There was one minor discrepancy that I discovered. During account registration, you are not asked to state your trading experience, trading goals, knowledge base, and personal financial information (an industry-standard practice that is used to assess risk and categorize traders). This is not a major transparency issue, though it would be beneficial to both OQtima and its clients if the broker implemented this practice to know and differentiate its clients better.

In summary, my research indicates that OQtima can be regarded as having a high level of trust and stability due to the following factors:

- Authorized by a top-tier regulatory body

- Adheres to most safety policies

- Has very high fee transparency

- Has a ‘best execution policy’

Fees

OQtima’s Trading Fees

OQtima’s Spreads

I tested OQtima’s spreads during the most actively traded times – the London open at 8:00 a.m. GMT and just after the U.S. open at 2:45 p.m. GMT. The test was conducted on 20 November 2023. The results are shown in the table below:

| Instrument | Live Spread AM | Live Spread PM |

| EURUSD | 0.0 pips | 0.0 pips |

| GBPJPY | 1.3 pips | 1.1 pips |

| Gold (XAUUSD) | 11 pips | 9 pips |

| Crude Oil | 0.2 pips | 0.2 pips |

| Apple | NA | 0.07 points |

| Tesla | NA | 0.14 points |

| Dow Jones 30 | 5 basis points | 4 basis points |

| Germany 40 | 4 basis points | 5 basis points |

| Bitcoin | $37 | $37 |

Broken down by asset class and compared to the industry average, OQtima features low spreads on FX pairs, commodities, and share CFDs, average spreads on cryptocurrencies, and average-to-high spreads on indices. I was especially impressed by the crude oil spread, which is one of the lowest I have recorded. I thus concluded that OQtima offers some of the lowest commodities spreads in the industry.

OQtima’s Swaps

A swap fee is a trader’s cost for holding an open position overnight because of changing interest rates. Swap long refers to the charge deductible or credit receivable for holding a buy position open overnight. In turn, swap short relates to the charges/credits deductible or receivable for holding a selling position open overnight.

The values listed below are for one full contract (100,000 units) of the base currency.

| Instrument | Swap Long | Swap Short |

| EURUSD | Charge of $6.15 | Credit of $2.22 |

| GBPJPY | Credit of $16.21 | Charge of $31.95 |

The recorded swap rates are average to high compared to the industry average.

OQtima’s Commissions

OQtima charges a $7 round-turn commission per traded lot (100,000 units). What that means is that you are charged $3.5 to open a full-sized (1 standard contract) trade and then an additional $3.5 to close the same position. This fixed commission exceeds the industry average and is applicable to FX pairs and commodities.

OQtima’s Non-Trading Fees

OQtima does not charge a handling fee for deposits and withdrawals, though third-party banking fees may apply. The broker also charges dormant accounts an inactivity fee of $30. It is charged monthly until activity resumes or the account balance drops to zero.

An account is considered dormant/inactive when no trades have been executed and no payments to or from the account have been made within one month. This waiting period is relatively short compared to what is true for most other brokers.

Are OQtima’s Fees Competitive?

To assess the overall competitiveness of a broker’s fees, it is important to examine its pricing mechanism as a whole. For instance, OQtima offers some of the lowest spreads on commodities in the industry, but it is also one of the few brokers that charge a fixed commission for trading commodities.

As a whole, I would say that OQtima’s fees meet the industry average, with some minor exceptions. Given that there is no commission on share CFDs and that the corresponding spreads are very low, I assessed that OQtima offers exceedingly favorable fees for trading instruments from this asset class.

Accounts Comparison

I have compiled the table below to help you better understand the difference between the trading fees on OQtima’s two account types. It illustrates the spreads and commissions I have recorded on the EUR/USD pair on the ECN+ and ONE account types. The table shows how much you will have to pay to trade 1 full lot (100,000 units) on the EUR/USD with a pip value of $10.

To calculate the cost of such a full-sized trade, I used this formula: Spread x pip value+commission

| Account Type* | Spread | Commission** | Net Cost |

| ECN+ | 0.0 pips | $7 | $7 |

| ONE | 1.1 pips | $0 | $11 |

*The numbers in this chart are only illustrative and subject to change over time

**Round-turn commission

My tests indicate that the ECN+ account type offers conditions that are better than the industry average (a net cost of around $10), whereas the ONE account type exceeds it slightly.

Platforms and Tools

I tested cTrader, which I assessed to deliver professional-grade performance. The platform is highly customizable and features multiple analytical tools. Chart artists can take advantage of this diversity to examine price action behavior from multiple angles and spot viable trading opportunities. cTrader is also an excellent choice for those interested in algorithmic trading and copy trading.

The cTrader platform has a special version that is designed for copy trading. It connects signal providers and strategy followers and helps the latter assess the risk/yield performance of a given trading strategy, its average returns, maximum dropdown, other risk factors, and more. You can do this by using the filters as shown above. Thus, beginners can select the best trading strategy that is the closest match for their goals, needs, and aspirations.

As regards algo trading, the cTrader platform has 12 built-in bots to be used under various trading conditions. It also provides one of the best environments for testing and creating algorithms, making it one of the most practical platforms for automated trading. Additionally, OQtima provides VPS hosting, which further enhances the performance of automated strategies.

cTrader has a highly versatile mobile app version, which can be used for trading on the go.

OQtima’s Desktop cTrader Platform

General Ease of Use

The platform may seem a bit overwhelming at first glance because of its multiple features, but this is misleading. It has an intuitive design, with its watchlists of selected instruments positioned on the left-hand side, a charts screen in the middle, and an orders execution panel on the right-hand side. I particularly liked that you can search for instruments by asset class from the search bar.

Charts

I consider the chart screen of a platform its most important feature. It aids technical analysis by providing an overview of price action behavior and allows traders access to a number of analytical tools and chart configuration possibilities. A good chart should afford easy scaling up and down of price action.

cTrader features all important tools like one-click trading (as seen above), an alert setting option, and more. It even has a few rare ones, like the ‘market reply’ option, which allows you to test the performance of your trading strategies based on historical market data. This makes the cTrader platform one of the best choices for up-and-coming traders wanting to tweak and perfect the parameters of their strategies.

I have broken down the available analytical tools and chart configurations below:

- 67 technical indicators. The platform supports trend-based, volume-based indicators, oscillators, and more. These can be applied to study price action behavior and determine the underlying market sentiment. In general, technical indicators are used to gauge where the market is likely to head next.

- 23 drawing tools. Drawing tools, such as Fibonacci retracement levels and Elliott waves, are used to study repeatable price patterns. Additionally, they can be applied to determine key support and resistance levels and potential breakout or breakdown levels. cTrader notably lacks any Elliott Waves configurations, which is one of its few drawbacks.

- 26 timeframes. The platform affords multi-timeframe analysis of price action behavior. The greater the number of timeframes, the more intricate examinations that can be carried out across the short-term and long-term. cTrader has one of the largest assortments of timeframes, which is one of its defining features.

- 6 chart types. The cTrader platform offers several chart-type configurations. This diversity makes it possible to examine potential trading opportunities from multiple angles.

Orders

I have broken down the available order types with cTrader below:

- Market orders. Market orders are used for immediate entry at the best possible price. If triggered, they guarantee volume filling, though there could be a discrepancy between the requested price and the price where the order actually gets filled.

- Limit orders. Unlike market orders, limit orders guarantee exact price execution. However, a limit order will not be filled if the price action does not reach the pre-determined execution price.

- Stop orders. They are used to support open positions by limiting the maximum loss that can be incurred if the market turns in the opposite direction. A stop-loss order is placed at a fixed price below or above the spot price. If the market does indeed turn and triggers the stop-loss, it will transform into a market order and get filled at the best possible price.

My Key Takeaways After Testing OQtima’s cTrader Platform

I consider cTrader one of the most well-rounded retail platforms in the industry. It has something for everybody, from copy trading to advanced charting tools. It is especially suitable for scalping because of its wide range of timeframes. I also found the platform very suitable for beginners wanting to learn about charting and technical analysis because cTrader features an extensive collection of educational videos on the implementation of various technical indicators.

OQtima’s cTrader Mobile App

cTrader’s mobile app retains most of the features that are available with its desktop version. It affords traders easy access to the market and to their accounts. Order execution is simplified, which is an essential requirement for a practical app. I also liked its sophisticated tool for gauging market sentiment.

My Key Takeaways After Testing OQtima’s cTrader Mobile App

While I’m usually wary of trading apps because I find them rugged and cumbersome (due to the inherent challenge of displaying complex information on small-screen devices), the mobile app version of cTrader is quite flexible. It presents information clearly and allows its users to make timely trading decisions or adjust their open positions. This is what I consider its greatest advantage.

Tradable Instruments

What Are CFDs?

Contracts for difference (CFDs) are derivatives used to speculate on the price of the underlying asset without physical delivery. For example, a long position on gold would generate profit as the price rises or incur a loss as it falls, all without the need to purchase actual gold bars. One of the biggest advantages of trading CFDs is that traders can get in and out of the market almost instantaneously, thereby catching even minute changes in the price of the derivative.

What Can You Trade With OQtima?

I have broken down the available instruments with OQtima below:

- 63 Currency Pairs

Major (7), Minor (27), Exotic (29) - 5 Commodities

Metals (3), Energy (2) - 750+ Share CFDs

US (650+), HK (104) - 19 Indices

Europe (6), US (5), Asia (3), Other (5) - 93 ETFs

Financial, Retail, Other - 45 Cryptocurrencies

Major and Minor

Compared to the broader industry, OQtima offers a high amount of share CFDs, indices, and cryptocurrencies, an average amount of FX pairs, and a low amount of commodities.

| Forex | Commodities |

| EURUSD | GBPJPY | USDCHF | AUDCAD | USDZAR | USDMXN | | Gold | Silver | Crude Oil | Platinum | Brent Oil |

| Share CFDs | Indices |

| Apple | Tesla | Microsoft | McDonald’s | Amazon | Nokia | Bank First Corp | Dow Jones 30 | Germany 40 | Nasdaq100 | Japan 225 | Australia 200 | VIX |

| ETFs | Cryptocurrencies |

| SPDR S&P 500 ETF Trust | iShares Core US Value ETF | iShares 3-7 Year Treasury Bond ETF | Bitcoin | Ethereum | Dogecoin | Solana | Ripple | Stellar | Polygon | Polkadot |

As mentioned above, the cTrader platform makes it easy to search for instruments across all available asset classes via its intuitive search tool.

My Key Takeaways After Exploring OQtima’s Tradable Instruments

I noticed that OQtima offers a comparatively modest selection of commodity CFDs, especially when contrasted with their extensive range of indices, share CFDs, and particularly cryptocurrencies. This made me conclude that their overall offering is conducive to well-balanced trading. You have the opportunity to utilize a mix of low-risk securities, such as ETFs, and higher-yield/risk assets like cryptocurrencies. This blend allows traders to engage in highly volatile opportunities while managing their underlying risk

I also liked that some crypto CFDs are denominated in multiple currencies, helping traders avoid having to pay conversion fees.

Customer Support

You can find OQtima’s telephone numbers and a question form here. If you choose to contact them via live chat, you may do so using Messenger, WhatsApp, Viber, Telegram, or the website’s own live chat.

Customer Support Test

When we test a broker’s customer support team, we evaluate the agent’s knowledge of their own website, how long it takes them to respond to questions, and how detailed their answers are.

I conducted my test on 20 November around 1:00 p.m. CET via live chat. An agent connected to the chat almost immediately. He was polite and introduced himself before responding to my question, which I appreciated. I asked him about the discrepancy between what is said on the website pertaining to their negative balance protection policy and the relative ambiguity of the Client Agreement. He did his due diligence and provided a satisfactory answer.

Deposit and Withdrawal

OQtima’s Deposit Methods

| Method | Currencies | Processing Time | Fee |

| Credit/Debit Cards | USD, BRL, JPY, EUR, AUD, CHE, CNY, CAD | Instant | $0 |

| Bank Wire | USD, BRL, JPY, EUR, AUD, CHE, CNY, CAD | 1-3 business days | $0 |

| Skrill | USD, BRL, JPY, EUR, AUD, CHE, CNY, CAD | Instant | $0 |

| Neteller | USD, BRL, JPY, EUR, AUD, CHE, CNY, CAD | Instant | $0 |

OQtima Withdrawal Methods

| Method | Minimal Withdrawal | Processing Time* | Fee |

| Credit/Debit Card | $20 | 1-3 business days | $0 |

| Bank Wire | $20 | 1-3 business days | $0 |

| Skrill | $20 | 1-3 business days | $0 |

| Neteller | $20 | 1-3 business days | $0 |

Account Types and Terms

Why is Choosing the Right Account Type Important?

Your account should reflect your goals, needs, and ambitions on the market. You should take into consideration several factors, such as whether the account type has a minimum deposit requirement, its spreads and commissions, the execution method, and more.

What Account Types Does OQtima Offer?

I have broken down the features of OQtima’s account types below:

| Account Type | ECN+ | ONE |

| Spread | From 0.0 pips | From 1.0 pips |

| Commission | $7 round-turn | $0 |

| Base Currencies | EUR, USD, GBP, CAD, CHF, JPY, SGD, ZAR | EUR, USD, GBP, CAD, CHF, JPY, SGD, ZAR |

| Minimum Deposit | $20 | $20 |

| Maximum Leverage | 1:500 | 1:500 |

| Hedging Allowed | Yes | Yes |

| Scalping Allowed | Yes | Yes |

| EAs Allowed | Yes | Yes |

| Islamic Accounts | Yes | Yes |

| Demo Accounts | Yes | Yes |

The biggest difference between the ECN+ and ONE accounts is underscored by their pricing mechanisms. The one features a fixed $7 round-turn commission and raw spreads starting from 0.0 pips, and the other offers commission-free trading and floating spreads starting from 1.0 pips. It is also interesting to point out that both have very low minimum deposit requirements, at $20, making them quite accessible to traders with different means.

What is CFD Leverage?

The leverage determines a trader’s overall market exposure. When trading Contracts for Difference (CFDs), positions can be opened for a fraction of their value because of the leverage. Essentially, the broker lends the trader money so that the latter can open bigger-sized positions. The leverage multiplies the profits a trader generates from winning positions but also the losses incurred from failed trades.

OQtima’s Execution Model

OQtima utilizes market execution. The broker operates on a Straight-Through-Processing (STP) basis without a dealing desk. Order requests are transmitted to the interbank level, where OQtima’s liquidity providers fill them. As long as there is enough liquidity in the market, all order requests will be filled, though at varying speeds.

In my experience, market execution is better suited for day trading and position trading strategies where volume execution is important. But it is less so for intraday trading strategies, such as scalping, where precise order filling is more important. Still, OQtima claims to average execution speeds of under 30 milliseconds. If true, this would put OQtima among the top-performing brokers globally.

OQtima’s Account Opening Process

The account creation process with OQtima is straightforward and quick. You can go at your own pace, though realistically, you will be done with everything within an hour. I have summarized the process step-by-step below:

- Step 1. Click ‘Get Started’ at the top-right corner of the main page.

- Step 2. Fill in your personal information, including your name, email address, password, and more.

- Step 3. Upload proof of address and proof of ID to verify your account.

- Step 4. Choose an account type (ECN+ or ONE).

- Step 5. Deposit funds after your account is verified to begin trading.

Why is a Demo Account Important?

OQtima offers demo accounts that introduce traders to the broker’s services and allow them to tweak their strategies in a risk-free environment. The market is continually evolving and never static, so it is important to hone your skills in a safe environment. You can set up a demo account for yourself alongside your live CFD account.

OQtima’s Restricted Countries

OQtima doesn’t provide its services in the following countries: Albania, Barbados, Belarus, Belgium, Burkina Faso, Côte d’Ivoire, Cuba, Cape Verde, Ethiopia, Fiji, Haiti, Iran, Jamaica, Jordan, Libya, Mongolia, Mozambique, Myanmar (Burma), Nicaragua, Panama, Palestinian Territories, Senegal, Seychelles, Sierra Leone, South Sudan, Syria, Tajikistan, Türkiye, Yemen, North Korea, Cyprus, France, Germany, Greece, Hungary, Italy, Latvia, Liechtenstein, Luxembourg, Malta, Poland, Portugal, Spain, United States, Czech Republic, U.S. Outlying Islands, U.S. Virgin Islands, Afghanistan, American Samoa, Guam, Iraq, Lebanon, Puerto Rico, Somalia, Sudan, Russia, Turkmenistan, Congo – Brazzaville, Congo-Kinshasa, Northern Mariana Islands, China.

Research

Research Tools

I have broken down OQtima’s research content by category below:

Economic Calendar

The economic calendar serves as the most basic research tool. It informs traders of upcoming economic releases that are likely to cause upsurges in market volatility. This creates potential trading opportunities. The economic calendar shows how the market is likely to react to specific events.

News Screener

Available from the platform, the news screener helps you stay on top of the latest financial and economic news that is currently driving the market. You can read about recent economic releases and policy decisions that could potentially result in viable trading opportunities.

TradingCentral Market Buzz

The Market Buzz feature represents TradingCentral’s gauge for assessing the underlying market sentiment. You can choose a particular market (e.g., stocks, forex, or crypto) and see which instruments are gaining and which are retreating. The tool gives you a general idea of how market participants are positioning themselves.

Featured Ideas

TradingCetnral develops well-researched and highly practical trading ideas. They contain a technical breakdown of the prevailing market sentiment, including a list of the most important pivot points and support and resistance levels. Traders are provided with a viable entry level, stop-loss level, and likely target level. The featured ideas notably lack a strong fundamental analysis.

Alpha Generation

Alpha Generation is a plugin for MetaTrader 4. It includes three intuitive indicators that help you assess the impact of mass market psychology and spot potential trading opportunities in the price action.

My Key Takeaways From Exploring OQtima’s Research Content

OQtima’s integration of content from TradingCentral, a leading and highly reputable signal provider in the industry, ensures that its active clients receive a comprehensive overview of the latest market trends. While this feature is a significant advantage, it is important to note that OQtima does not offer any in-house research content.

Education

The cTrader platform has multiple built-in educational videos explaining how to use certain technical indicators. As shown in the image above, you have to click on the camera icon to access these videos from cTrader’s YouTube Channel.

There are also a handful of explanations of essential trading concepts, which are available from the FAQ section of the website.

The Bottom Line

OQtima is a promising new forex and CFD broker that is still perfecting its service. Founded in 2022 and headquartered in Cyprus, OQtima is quickly turning into a reliable partner to beginner and advanced traders globally.

The broker is regulated by CySEC in Cyprus and FSA in Seychelles and adheres to the most essential safety requirements. I also assessed it to be fairly transparent and trustworthy. Its fees are mostly competitive, though this varies across instruments from different asset classes. Speaking of which, OQtima provides a very well-balanced offering of lower-risk securities and higher-yield/risk assets.

The broker incorporates the renowned MetaTrader 4 and superior cTrader platforms. In my opinion, the latter is more versatile, better for market and price action analysis, and features a comprehensive set of automated and copy trading tools.

While OQtima grants its clients access to research content from the professional-grade TradingCentral service, it has almost no educational materials. However, I contacted customer support and was assured that at the time of my review, the broker was currently working on developing more educational content for the benefit of beginners.