Brand Review: NXG Markets – Introduction

Welcome to our brand review of NXG Markets, where we peel back the layers of a platform shrouded in suspicious details. Our in-depth investigation uncovered elements that immediately raise doubts: a domain registration date that oddly precedes the brand’s official launch, shell licenses that hardly inspire trust, and reviews that seem too uniform to be genuine. Isn’t it strange that fraudsters would attract extra clients when those very clients could quickly expose their scam? As we navigated through these red flags, one question kept echoing in our minds: why would scammers risk attracting vigilant eyes? Join us as we explore the subtle tactics and deliberate inconsistencies that suggest NXG Markets may be playing a dangerous game.

| Category | Details |

| Account Types | Standard, Demo, Premium |

| Contact Details | Generic email; limited phone support |

| Leverage Offered | Up to 1:1000 |

| Domain Registration Date | Domain bought before brand launch |

| License Type | Shell license (Fake) |

| Trustpilot Reviews | Score below 4; uniform reviews |

| Trading Platforms | Vague details |

| Minimum Deposit | Not clearly specified |

| Additional Notes | Raises transparency concerns |

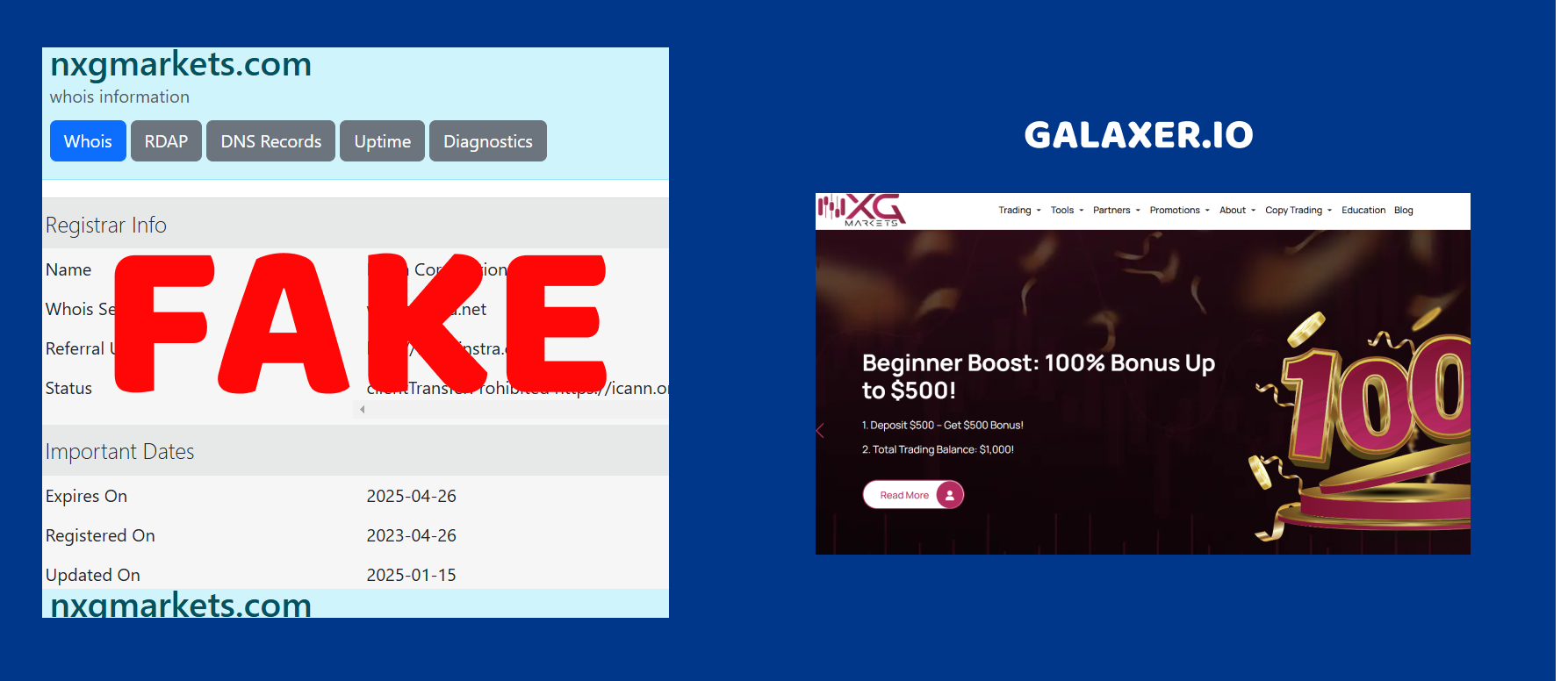

Brand Review: NXG Markets – Domain Creation Analysis

Digging into NXG Markets, our team from Galaxer examined the domain registration details and uncovered a striking discrepancy. The domain was registered well before the brand’s official launch, which immediately raises a curious question: isn’t it strange to see a website’s inception predating the company it claims to represent? After our thorough investigation, we noticed that this gap in dates isn’t just a minor oversight—it appears to be a deliberate tactic. One might ask, why would scammers want extra clients who could swiftly expose their scheme if they already bank on a façade of longstanding credibility? The creators of the site have once again distinguished themselves by deploying such a timeline, leaving us pondering the underlying intentions behind this maneuver.

Brand Review: NXG Markets – Licensing Analysis

After our team’s thorough investigation, we discovered that NXG Markets’ license is issued by a regulatory body that bears little to no responsibility—a classic red flag. The licensing authority appears to be a shell organization, one that’s notorious for granting licenses to firms that have little intention of genuine accountability. Isn’t it odd that a platform, which prides itself on legitimacy, relies on such questionable credentials? It almost seems like a calculated move, a way to mask the underlying scam while luring in unsuspecting traders. When our experts dug into the records, they marked this license as Fake in the Type License column—a clear indication that something doesn’t add up.

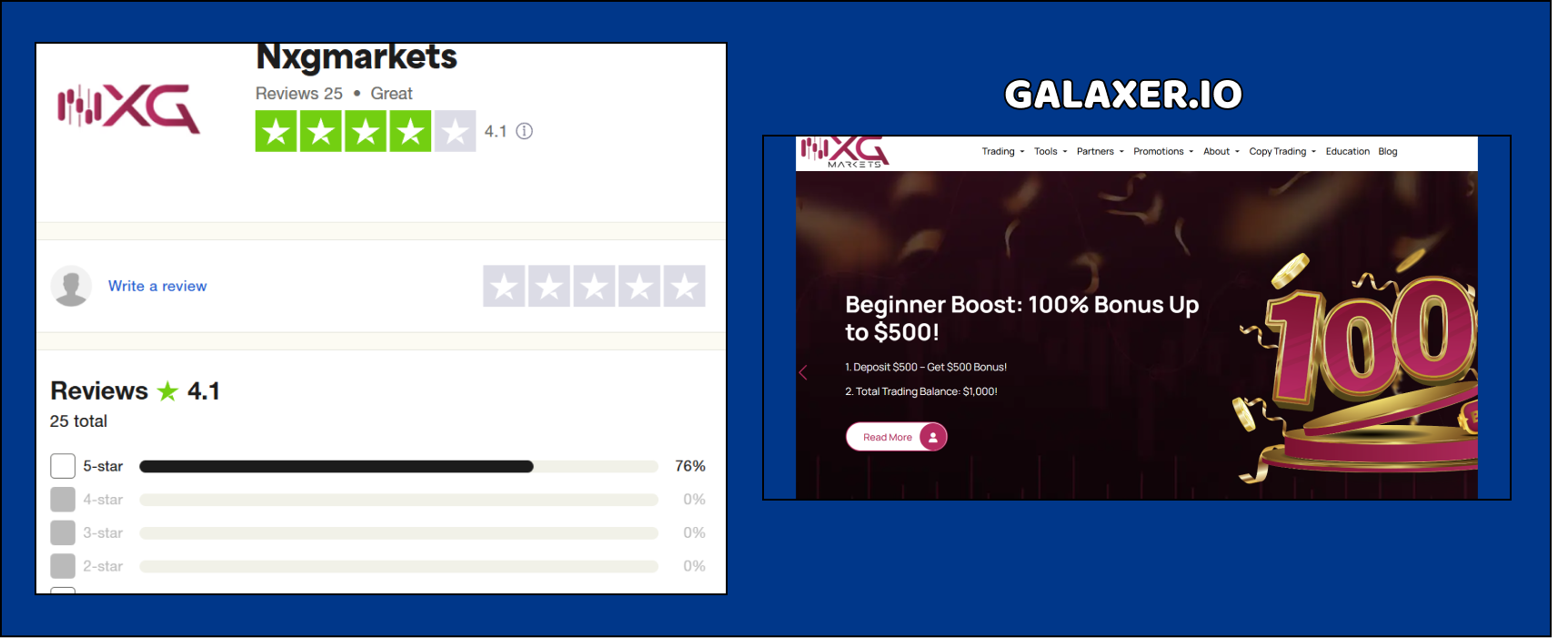

Brand Review: NXG Markets – Reviews Analysis

When we delved into NXG Markets’ reviews, our team quickly noticed that the overall score on Trustpilot is disturbingly below 4. This low rating immediately makes you wonder: how can a supposedly reputable broker have such dismal customer feedback? On top of that, the few positive reviews that do exist are eerily uniform. They all seem to be written in the same tone and style, almost as if they were generated by a single source or script. Isn’t it strange that genuine customer opinions rarely sound so identical? Our investigation revealed that this pattern is too consistent to be mere coincidence. It appears that these overly polished, homogeneous reviews are an attempt to create a false sense of trustworthiness. After analyzing the language and structure, our experts suspected that these reviews were artificially boosted. Why would fraudsters risk attracting savvy clients who could quickly spot such contrivance? The uniformity in the feedback not only raises doubts about its authenticity but also points to a calculated effort to mask the broker’s true reputation.

Brand Review: NXG Markets – Final Conclusion

After a deep dive into NXG Markets, the evidence we uncovered paints a troubling picture. The domain’s premature registration, the questionable shell license, and the overly uniform reviews all seem to be pieces of a larger puzzle designed to deceive. Isn’t it strange that a platform would go to such lengths when every suspicious detail only makes it easier for savvy clients to see through the charade? When we examined the timeline, it became clear that every red flag—from the early domain purchase to the dubious regulatory credentials—points to a deliberate effort to fabricate legitimacy. These tactics are classic hallmarks of a scam operation, carefully constructed to mislead unsuspecting traders. Ultimately, one must wonder: why risk attracting extra clients who could quickly expose the truth? The cumulative inconsistencies leave little doubt that NXG Markets may not be as reputable as it claims to be.